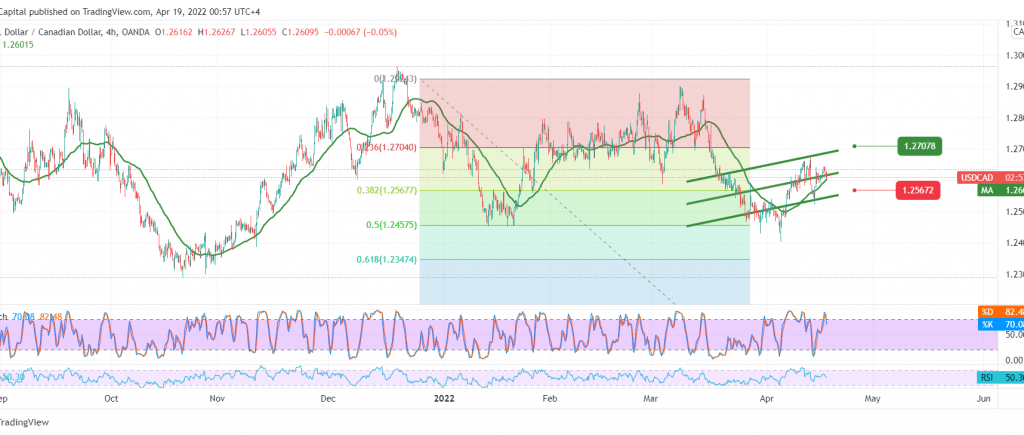

The Canadian dollar is trying to recover again within successful attempts to get more bullish momentum to retest the 1.2645 resistance level.

Technically, by looking at the 4-hour chart, we notice the return of the 50-day moving average to hold the price from below, in support of the bullish price curve, in addition to the positivity of the 14-day momentum indicator on the 60-minute time frame.

Therefore, the bullish scenario may be the most likely today, knowing that consolidation above 1.2665 can extend the weight to visit 1.2720/1.2700.

Only from below, trading stability returns below 1.2570, 38.20% correction, which postpones the attempts to rise and puts the pair under temporary negative pressure, targeting returning 1.2540 and 1.2510 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2540 | R1: 1.2665 |

| S2: 1.2475 | R2: 1.2720 |

| S3: 1.2420 | R3: 1.2780 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations