The Canadian dollar maintained stability within the expected positive technical outlook, touching the official target required to be achieved at 1.3205, recording its highest level at 1.3200.

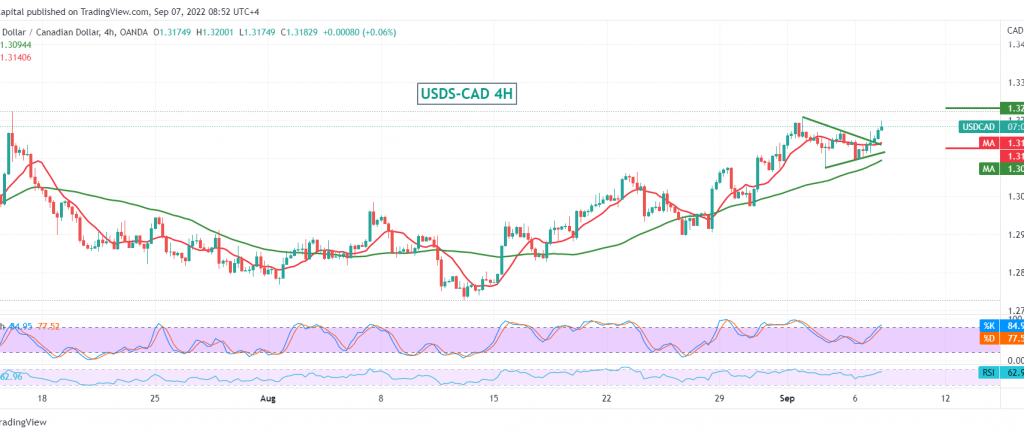

Technically, we find the pair succeeded in forming a good support floor around 1.3120, trying intraday stability above the 1.3170 resistance level. Looking at the 4-hour chart, we find the simple moving averages still supporting the bullish price curve, in addition to the stability of the RSI above the mid-line 50.

Therefore, the bullish bias is the most likely one. However, we are only waiting for confirmation of the breach of 1.3200, and this is a catalyst that enhances the chances of touching 1.3225 and 1.3265, respectively, and gains may extend later towards 1.3300.

Only from below the return of the stability of trading and the price stability below 1.3120 indicates the chances of rising. Still, it does not cancel it, and we witness a retest of the strong support of 1.3050 before attempts to rise again.

Note: We are waiting for the “Canadian interest rate and the Bank of Canada statement, ” which have a high impact and may cause high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations