As we expected, a bullish corrective bias dominated the Canadian dollar’s movements yesterday, touching the corrective target at 1.2590, recording the highest price at 1.2592.

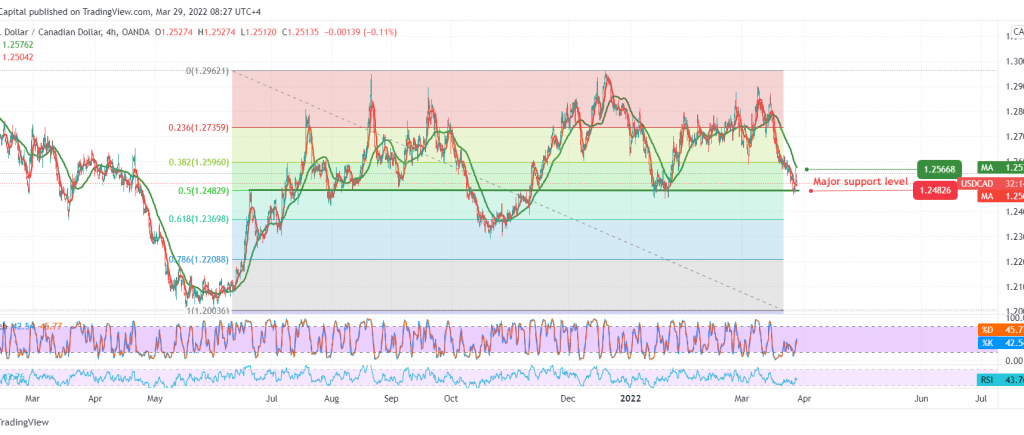

Technically, we notice that the pair succeeded in building a base of 1.2480 support, located around the 50.0% Fibonacci correction, accompanied by the clear positive crossover signs on the stochastic indicator.

There may be a possibility of a bullish bias in the coming hours, knowing that the breach up and rise above 1.2565 is a motivating factor that enhances the chances of rising to visit 1.2615 and 1.2640, respectively.

The return of trading stability and price stability below the pivotal support level of 1.2480 will stop the expected bullish correction attempts and lead the pair to the official descending path with an initial target of 1.2450 and extend towards 1.2400. Note: the 50-day moving average still forms negative pressure on the pair.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2450 | R1: 1.2565 |

| S2: 1.2400 | R2: 1.2615 |

| S3: 1.2365 | R3: 1.2640 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations