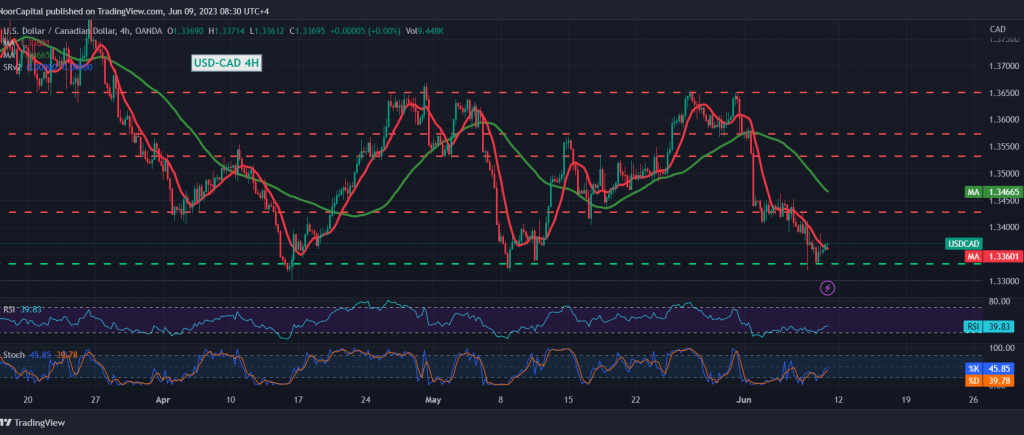

The Canadian dollar declined significantly yesterday, within the expected bearish path during the previous technical report, as the support level of 1.3350 succeeded in limiting the bearish bias.

Technically, the pair breached the support level of 1.3420 and turned into a resistance level. The simple moving averages continue to pressure the price from above and support the daily bearish price curve.

The daily trend tends to be down, knowing that stability and constancy of the price below 1.3350 facilitate the task required to visit 1.3310, knowing that breaking it increases and accelerates the strength of the bearish trend, opening the door towards 1.3260, and the gains may extend later towards 1.3205 as long as trading remains stable below 1.3420.

The price’s consolidation and the upward breach of the previously broken support 1.3420 postpone the chances of a downside move and lead the pair to retest 1.3475 & 1.3500.

Note: Today we are awaiting high-impact economic data issued by the Canadian economy, “change in jobs” and “unemployment rates,” and we may witness high price fluctuations at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations