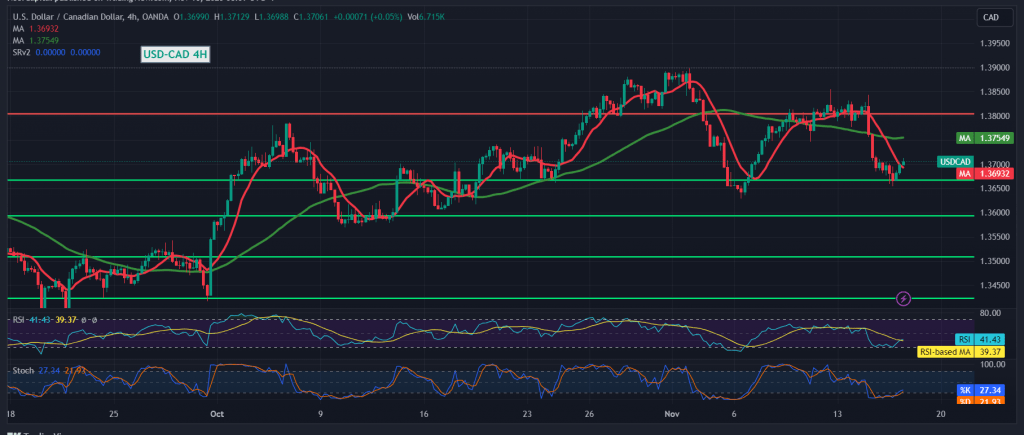

The Canadian dollar has been making positive strides to uphold its stability above the support level of 1.3680 for two consecutive sessions. The pair’s intraday movements maintain proximity to its highest level during this morning’s trading session at 1.3705.

From a technical analysis standpoint, examining the 4-hour chart reveals that the pair has achieved stability above 1.3680. The 14-day momentum indicator continues to emit positive signals that could propel the pair to register gains in the forthcoming hours.

Consequently, the possibility of reaching 1.3750 as a primary target still exists. It’s important to note that price consolidation above this level could serve as a catalyst, opening the route towards 1.3780, with subsequent gains potentially extending towards 1.3830.

Remember that an hourly candle closing below 1.3680 could potentially disrupt the proposed bullish scenario, subjecting the pair to negative pressure to retest 1.3630.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations