Negative momentum dominated the movements of the Canadian dollar, coming within a few points of the first official target set in the previous report at 1.3380, reaching its lowest level at 1.3397.

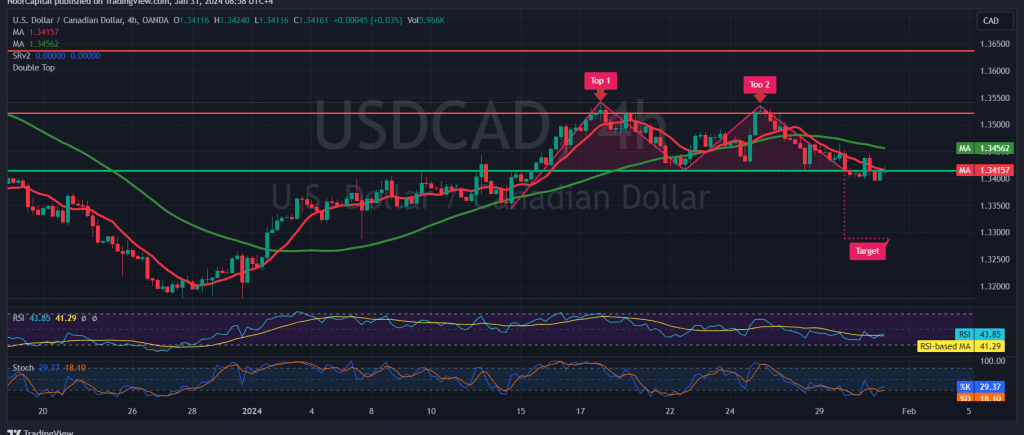

In today’s technical analysis, a bearish sentiment is favored in our trading outlook, relying on the intraday stability below the previously breached support level, now converted to a resistance level at 1.3420. Additionally, the pair continues to face negative pressure from the 50-day simple moving average.

There’s a likelihood of a bearish bias during today’s trading session, targeting 1.3380 as the first objective. A breach below this level could pave the way for a visit to 1.3350, representing the next target.

On the upside, a decisive upward jump and consolidation above 1.3420, particularly 1.3440, would invalidate the bearish scenario, directing the pair to retest 1.3500.

Cautionary Notes:

- Today, high-impact economic data is expected from the American economy, including changes in private non-agricultural sector jobs, the interest rate, the Federal Reserve Committee statement, and the press conference of the Chairman of the Federal Reserve. Expect sharp price fluctuations during the news release.

- The risk level is elevated, especially considering ongoing geopolitical tensions, potentially leading to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations