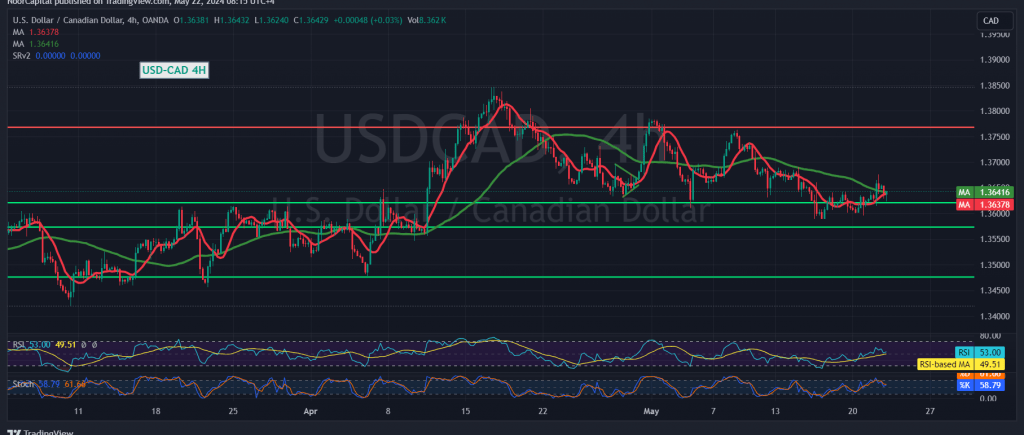

Limited positive trading dominated the Canadian dollar’s movements during the previous session, failing to breach the 1.3675 resistance level and resulting in a negative bias.

Technical Analysis

Examining the 4-hour chart reveals the following:

- Stochastic Indicator: Continues to provide negative signals.

- 50-Day Simple Moving Average: Trading stability below this level supports a bearish outlook.

Downward Targets

Given these technical signals, the bearish bias is preferred with key targets as follows:

- First Target: 1.3600. Breaking this level increases negative pressure.

- Second Target: 1.3570.

Potential Reversal

A return to trading stability above 1.3675 could invalidate the bearish scenario and lead to a recovery, with potential targets at:

- First Target: 1.3705.

- Second Target: 1.3750.

Market Volatility Alert

Today, significant market volatility is expected due to the release of critical economic data from the United States, particularly the Federal Reserve Committee meeting results.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations