Analysis of Currency Pair Dynamics and Technical Indicators

The Canadian dollar (CAD) has demonstrated an upward trend in the early trading sessions of this week, marked by a decisive breach of the 1.3440 resistance level. This surge has nullified the bearish scenario previously anticipated and positioned the pair for further gains, with potential targets at 1.3500 and beyond.

Market Dynamics

Confirmation of Breakout

The CAD exhibited notable strength as it confirmed the breach of the critical resistance level at 1.3440. This development has invalidated the bearish outlook and set the stage for a bullish continuation in the pair’s trajectory.

Technical Analysis

Indicators and Resistance Levels

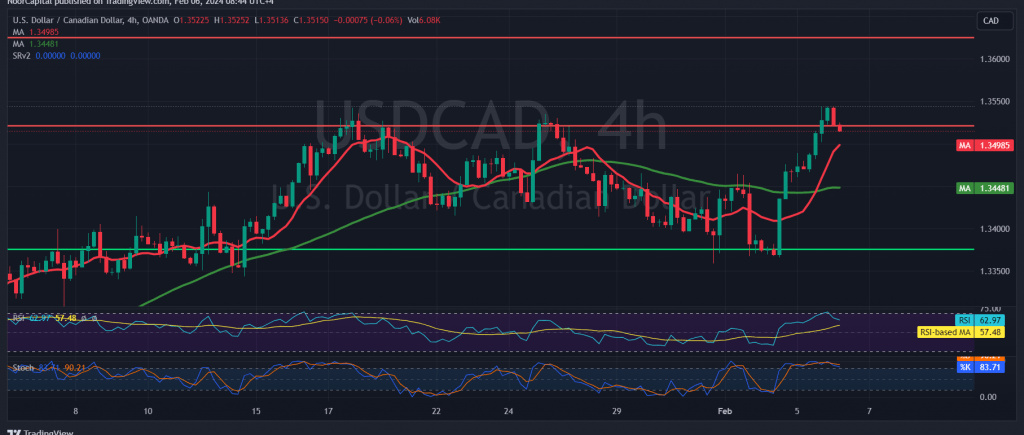

Upon analysis of the 4-hour timeframe chart, key technical indicators and resistance levels come into focus:

- Stochastic Indicator: The Stochastic indicator, positioned around overbought territories, is showing signs of waning upward momentum. This suggests a potential reversal in the pair’s bullish trajectory.

- Intraday Resistance: The intraday trading remains below the formidable resistance level at 1.3540, indicating a significant barrier for further upward movement.

Potential Scenarios and Targets

Bearish Bias

In the coming hours, there may be a bearish bias in the pair’s movement, particularly if it slips below the key psychological level at 1.3500. This could pave the way for a retest of the first target at 1.3470, followed by a potential revisit of the breached resistance-turned-support level at 1.3440.

Reversal Conditions

A reversal of the bearish sentiment would necessitate the pair reclaiming stability above the resistance-turned-support level at 1.3555. In such a scenario, the pair could embark on its official upward trajectory, targeting levels around 1.3600/1.3590.

Risk Assessment

High Risk Level

Given the prevailing geopolitical tensions and potential for heightened price volatility, traders should exercise caution. The inherent risks associated with trading demand vigilant risk management strategies to mitigate potential losses.

Conclusion and Tactical Considerations

Navigating Market Volatility

Traders should closely monitor price movements and adapt their strategies accordingly in response to evolving market dynamics. Implementing effective risk management protocols and staying informed about geopolitical developments will be crucial for making informed trading decisions amidst the heightened volatility in the CAD pair.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations