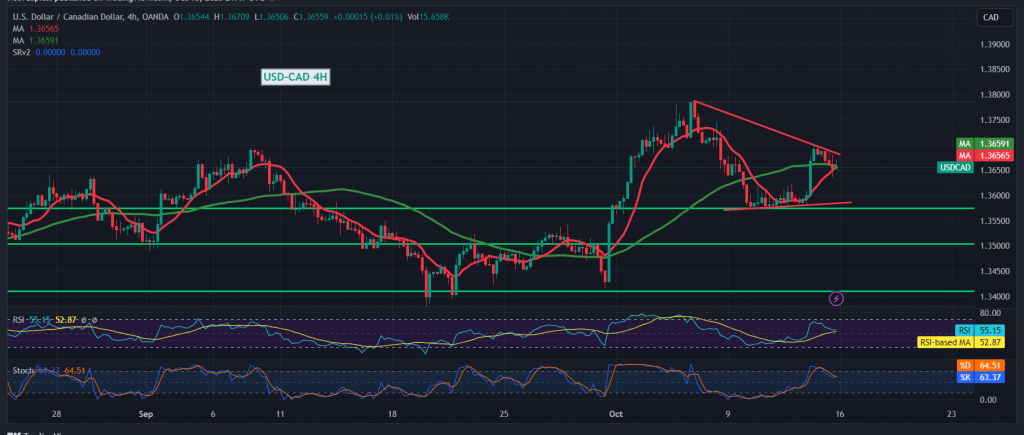

Mixed trading dominated the movements of the Canadian dollar during the previous trading session after it found a strong resistance level around the psychological barrier of 1.3700.

Technically, we find the pair hovering around the previously breached resistance level converted into support at 1.3650, and we find the 50-day simple moving average starting to form negative pressure on the price from above, in addition to the negativity of the Stochastic indicator.

We may witness a bearish bias during today’s trading session, provided that we notice the price consolidating below 1.3650, targeting 1.3590 as a first target, and breaking it may extend the losses as we wait for 1.3530, unless we see any trading above 1.3710.

From the top, if the price is breached above 1.3710. From here, the pair returns to the official upward path with an initial target of 1.3765, extending towards 1.3830 levels.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations