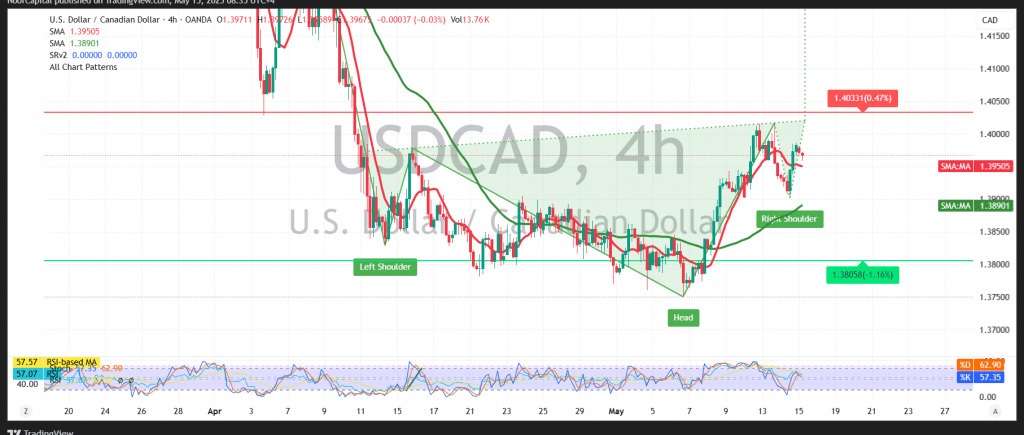

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base around the psychological level of 1.3900.

From a technical standpoint, the 4-hour chart indicates that bullish momentum is gaining traction. The pair is now supported by upward-sloping simple moving averages, which are once again acting as dynamic support and encouraging further gains.

As long as trading remains above 1.3900, the bullish scenario remains intact. The next target is the 1.4000 resistance level, a key psychological barrier. A confirmed break above this level could act as a bullish catalyst, opening the door for a potential advance toward the next resistance at 1.4040.

Conversely, a return to stable trading below 1.3900 would undermine the current bullish momentum and place the pair under renewed pressure. In this case, the initial downside target would be 1.3865.

Key Event Risk Today:

Expect significant market volatility tied to upcoming U.S. economic data releases, including:

- Retail Sales

- Producer Price Index (PPI)

- Unemployment Claims

- Speech by a Federal Reserve Governor

These events may heavily influence USD/CAD price action.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations