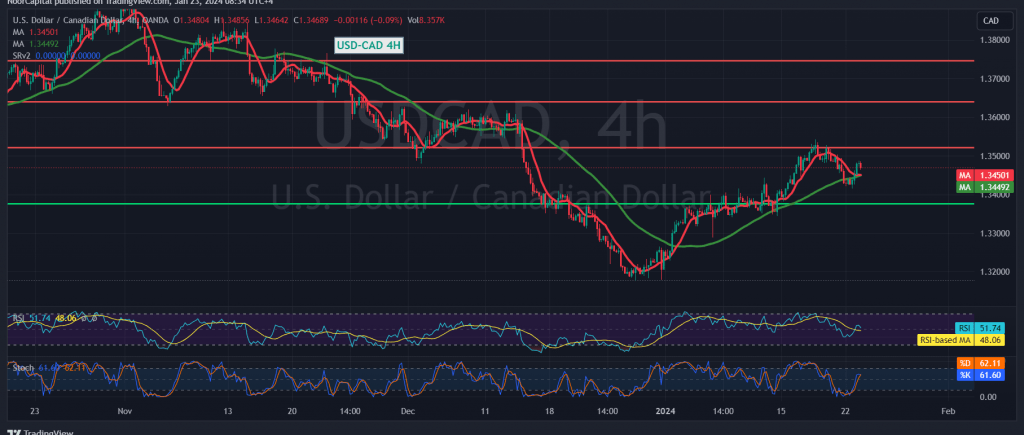

The Canadian dollar experienced an upward movement in the previous trading session, following an upward trend and reaching its highest level at 1.3486.

In terms of technical analysis, intraday trading is currently stable below the psychological barrier resistance of 1.3500. Additionally, the 14-day momentum indicator is showing negative signals, suggesting the potential for negative movements in the coming hours.

There might be a retest of the 1.3430 and 1.3380 levels, serving as the initiation of an upward rebound. However, it’s important to note that an upward jump and consolidation above 1.3530 would nullify the idea of retesting and could lead the pair to continue the upward trajectory directly towards the previously mentioned analysis targets at 1.3570 and 1.3600.

Traders are advised to exercise caution as the risk level may be high, particularly given ongoing geopolitical tensions that could contribute to increased price volatility. Monitoring market developments and price movements is crucial in making informed trading decisions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations