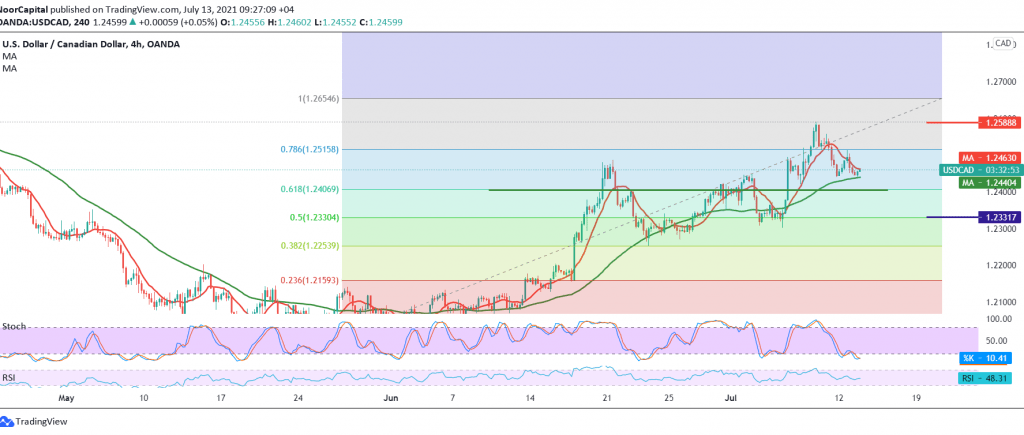

During the last trading session, the Canadian dollar rose, touching the official target station in the previous analysis, located at 1.2520, to record its highest level at 1.2515.

Technically, the current moves are witnessing a bearish slope due to the collision with the resistance level of the psychological barrier 1.2500. However, with careful consideration of the chart, we find the simple moving averages still supporting the bullish price curve, in addition to the stability of trading above 1.2410 Fibonacci correction of 61.80.

Therefore, we tend to be positive, targeting 1.2500, and we should pay close attention to the fact that price stability above the mentioned level is a catalyst that increases the possibility of touching 1.2554 and 1.2575, respectively. Gains may extend later to visit 1.2600.

The price’s breach of the 1.2410 support level will postpone the chances of rising, and we may witness a bearish bias that aims to retest 1.2330, 50.0% correction before attempts to rise again.

| S1: 1.2410 | R1: 1.2500 |

| S2: 1.2365 | R2: 1.2545 |

| S3: 1.2320 | R3: 1.2575 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations