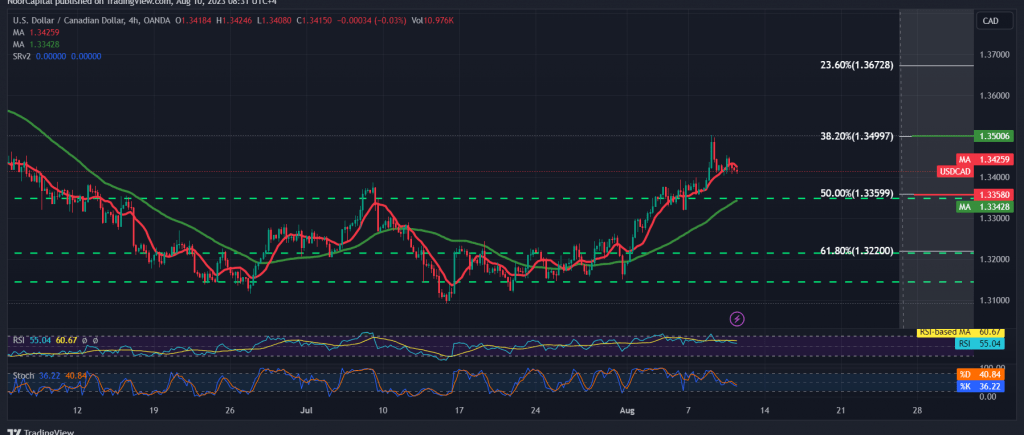

After several successive sessions of achieving gains, the Canadian dollar found a strong resistance level near 1.3450, which formed a strong resistance that put the pair under temporary negative pressure.

Technically, the 50-day simple moving average still holds the price from below, and it meets near 1.3350, representing a good support level. On the other hand, we find the stochastic providing negative signals.

We tend to rise, but there is a possibility to retest 1.3355 before rising again, knowing that the retest scenario does not contradict the bullish trend, whose official targets are around 1.3555 & 1.3560 once the price consolidates above 1.3455.

It should be noted that confirming a breach of 1.3355 can thwart the bullish scenario, and we are initially witnessing the beginning of forming a bearish bias towards 1.3300.

Note: Today we are awaiting high-impact economic data issued by the US economy, “Consumer Price Index” and “Weekly Unemployment Claims”, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations