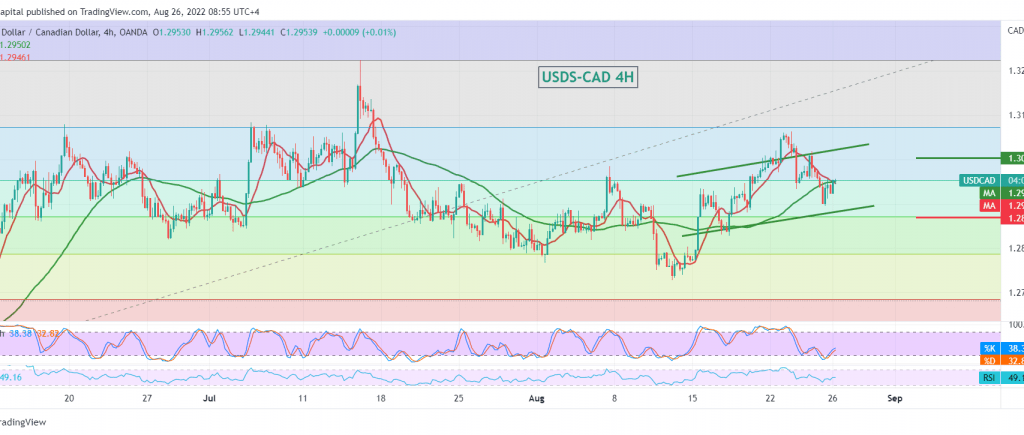

The Canadian dollar provided mixed trading yesterday, approaching a few points from the target published during the previous analysis at 1.2880, recording its lowest price at 1.2895.

Technically, we find that the pair returned to the bullish rebound, benefiting from the pivot on the solid support floor of 1.2880. We also find that the 14-day momentum indicator is getting positive signs again.

There may be a possibility of a bullish bias in the coming hours, knowing that the breach of 1.2950 is a catalyst that enhances the chances of touching 1.2985 and 1.3000, respectively, and we should pay close attention if the pair manages to breach 1.3000 that leads the pair to visit 1.3030.

Stability below the vital demand area of 1.2870 will initially lead to a downward correction tendency, targeting 1.2830.

Note: Throughout today’s session, the “Jackson Hole” economic forum is being held, and it has an essential impact on the markets, and we may witness random movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations