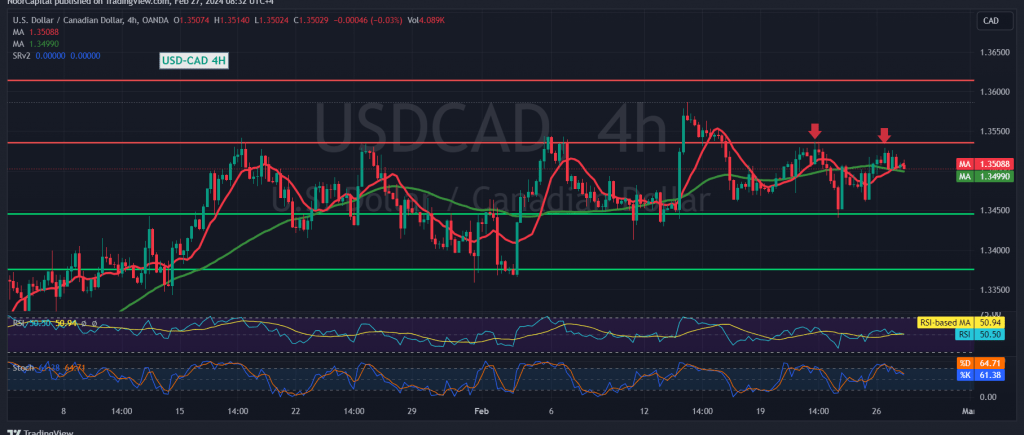

The Canadian dollar experienced tranquil trading conditions with a slight positive bias, manifesting a sideways trend confined between the lower boundary around 1.3500 and the upper threshold below 1.3535.

Today’s technical analysis, upon scrutiny of the 4-hour timeframe chart, reveals the simple moving average endeavoring to uplift the price. However, the pair is exerting pressure on the psychological support barrier at 1.3500, concomitant with the Relative Strength Index indicating a diminishment in upward momentum on shorter timeframes.

In the ensuing hours, there is a possibility of a bearish inclination, targeting a retest of the support level between 1.3460 and 1.3470. Close monitoring of the pair’s price action is warranted upon touching and breaching the aforementioned level. Should this occur, the pair may undergo further downward pressure, potentially revisiting 1.3430 before contemplating a resurgence.

Conversely, a breakout to the upside, coupled with price consolidation above the pivotal resistance at 1.3535, would invalidate the temporary bearish scenario, prompting the pair to resume its upward trajectory. Initial targets would commence at 1.3560, with further gains extending towards 1.3590.

A word of caution: Today’s market sentiment is under the influence of eagerly anticipated economic data from the American economy, particularly the “Consumer Confidence Index,” potentially inciting heightened volatility upon its release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations