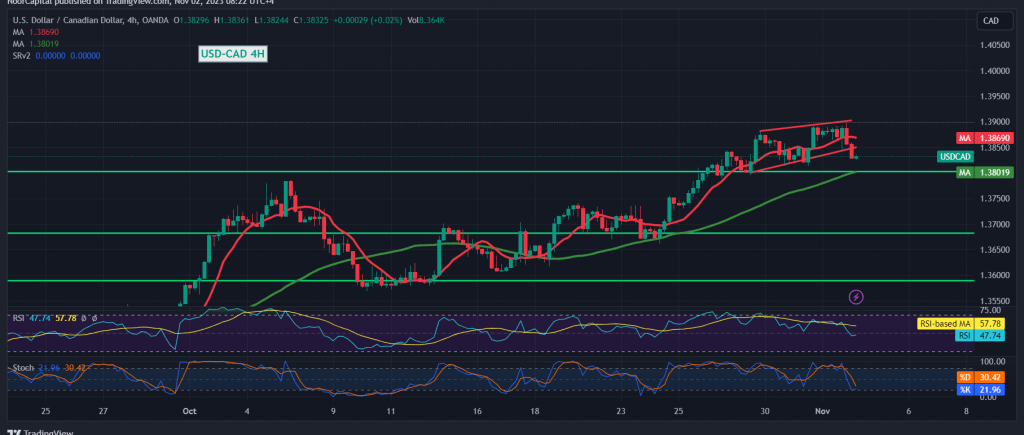

Mixed trading characterized the movements of the Canadian dollar, managing to reach the initial upward target at 1.3900 in today’s trading session.

From a technical perspective, the psychological barrier resistance at 1.3900 created negative pressure, leading the pair to retest the support level at 1.3830, where it stabilized. Upon closer examination of the 4-hour chart, the Stochastic indicator is signaling negativity, gradually losing its upward momentum, particularly in short time frames.

While there is a bias towards negativity, a clear and robust breach of the 1.3830 support level is needed to target 1.3800 as the initial objective. Breaking this level opens the path further down to 1.3775, unless the pair starts trading above 1.3880.

On the contrary, if the pair regains stability above the resistance level of 1.3880, it would halt the chances of further decline. In such a scenario, the pair could revert to its official upward trajectory, targeting 1.3930 and 1.3960, respectively. Traders should closely monitor these key levels for potential trading decisions.

Please be aware that today, high-impact economic data originating from the British economy is anticipated, including the Bank of England governor’s speech, the interest rate decision, the monetary policy summary, the monetary policy report released by the Bank of England, and the Monetary Policy Committee’s vote on interest rates.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations