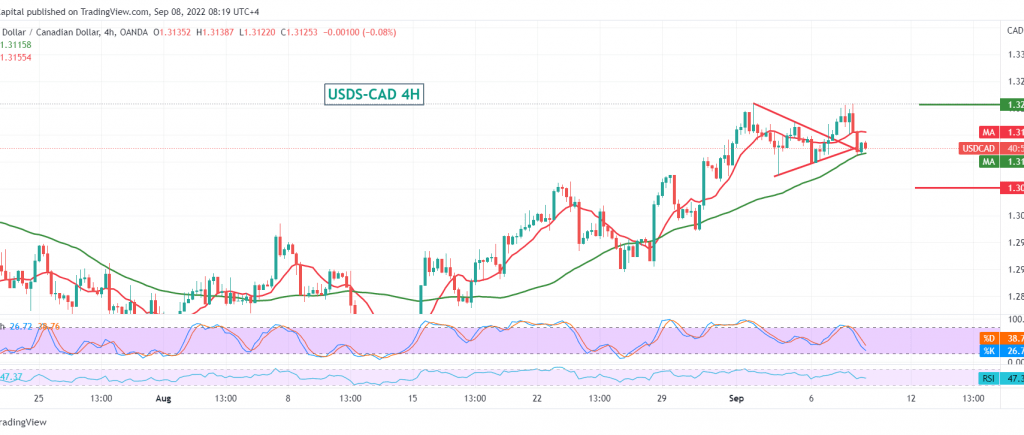

Mixed trading dominated the movements of the Canadian dollar, affected by the decision of the Bank of Canada regarding interest rates. The pair failed to breach the 1.3200 resistance, which forced it to form a bearish slope to retest the 1.3120 support level.

Technically, and by looking at the 4-hour chart, we notice the clear negative features on the stochastic indicator, in addition to the stability of the intraday trading below 1.3160.

Therefore, we may witness a bearish bias in the coming hours, provided that we witness a clear break of the 1.3120 support level, and this will facilitate the task required to retest 1.3050/1.3060.

The return of stability above 1.3200 leads the pair to regain the official bullish track, so we are waiting for 1.3225 and 1.3265, respectively.

Note: The ECB rate decision, press conference, MPC statement, and Fed Chairman’s speech are due today; all could lead to price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations