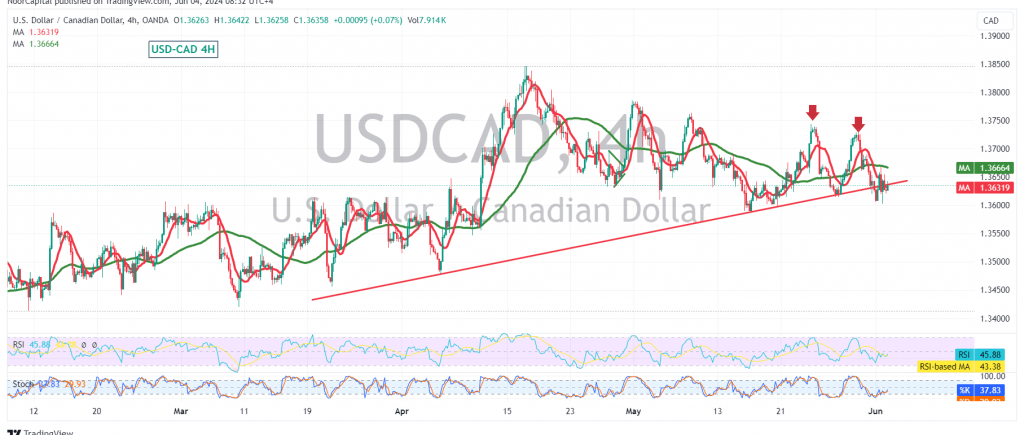

The Canadian dollar experienced a subdued trading session yesterday, characterized by narrow fluctuations within a broader bearish trend. The currency pair reached a low of 1.3603 against the US dollar.

Technical analysis suggests a continuation of this downward momentum. The Stochastic oscillator on the 240-minute timeframe is showing signs of weakening upward momentum, while the pair remains below the key resistance levels of 1.3670 and 1.3690.

These indicators point towards a likely downward trend during the day’s trading. A break below the 1.3600 support level could open the door for a further decline towards 1.3570 and 1.3535.

However, traders should remain vigilant as a return of trading stability above 1.3690 could invalidate the bearish scenario. This could trigger a bullish reversal, potentially pushing the pair towards 1.3740.

It’s crucial to note that the upcoming release of high-impact economic data from the U.S. economy, specifically the Consumer Confidence Index, could introduce significant volatility into the market. This data is expected to influence market sentiment and could potentially impact the Canadian dollar’s direction.

In conclusion, the Canadian dollar faces downward pressure in the short term, but the potential for a bullish reversal remains if the pair can break above key resistance levels. Traders are advised to exercise caution and closely monitor the market’s reaction to the upcoming U.S. economic data.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations