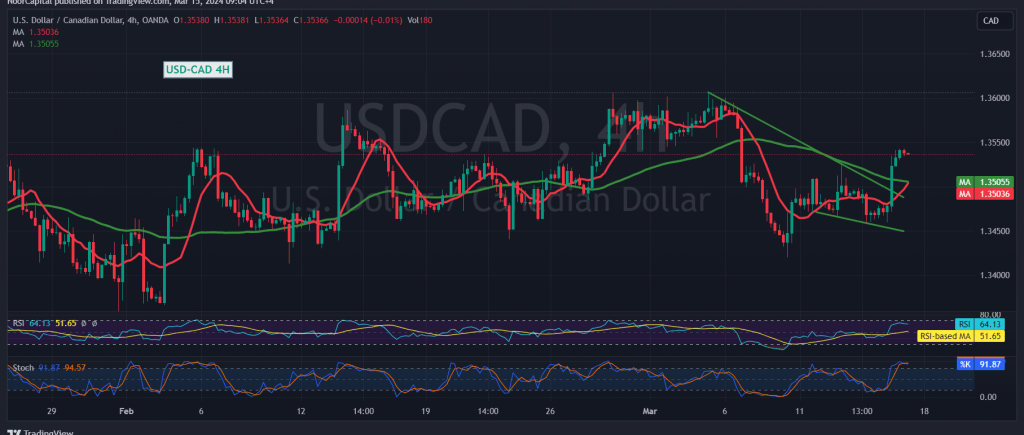

An upward trend dominated the movements of the Canadian dollar during the previous trading session after it was able to penetrate the resistance level of the psychological barrier 1.3500, recording its highest level at 1.3543.

From the technical analysis angle today, we are leaning toward positivity, relying on stability above 1.3500, accompanied by the positive incentive coming from the simple moving averages that returned to carry the price from below.

Therefore, the upward bias will be the most preferred during the day, targeting 1.3570, and the price’s consolidation above it increases the chances of touching 1.3600, the next official station.

The return of trading stability below 1.3480 renews the chances of negative pressure and the pair returns to the official bearish path with targets starting at 1.3430.

Warning: Today we are awaiting high-impact economic data issued by the American economy, “New York State Manufacturing Index, preliminary reading of the Consumer Confidence Index issued by the University of Michigan,” and we may witness high fluctuation in prices at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations