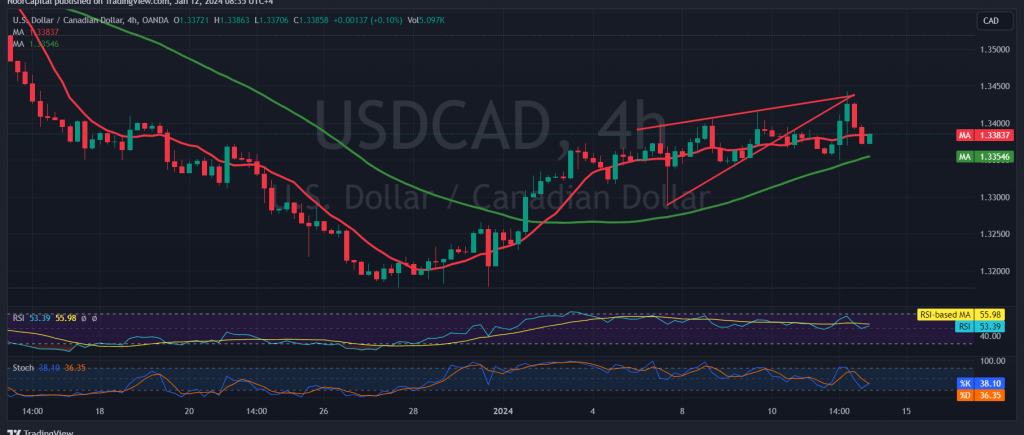

The Canadian dollar experienced an upward trend, aligning with the anticipated positive outlook outlined in the latest technical report. The currency touched the target at 1.3430 and recorded its highest level at 1.3443.

From a technical perspective today, there are early signs of negativity emerging on the Stochastic indicator. Furthermore, intraday trading has stabilized below the 1.3440 resistance level.

While the 50-day simple moving average continues to provide positive motivation, there is a possibility of a bearish tendency emerging in the coming hours. The target for this potential correction lies around 1.3340 and 1.3320. However, the expectation is for the Canadian dollar to resume the upward trend after this correction. Official targets for the upward trend are around 1.3485 and 1.3530, contingent on breaching the 1.3440 resistance level.

Warnings:

- High-impact economic data is anticipated from the American economy today, including the “monthly core producer prices” and the “monthly producer price index.” Additionally, the “monthly gross domestic product” indicator from the United Kingdom is expected, which may lead to heightened volatility during the news release.

- The risk level is considered high, particularly amidst ongoing geopolitical tensions, potentially contributing to increased price volatility. Traders are advised to exercise caution.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations