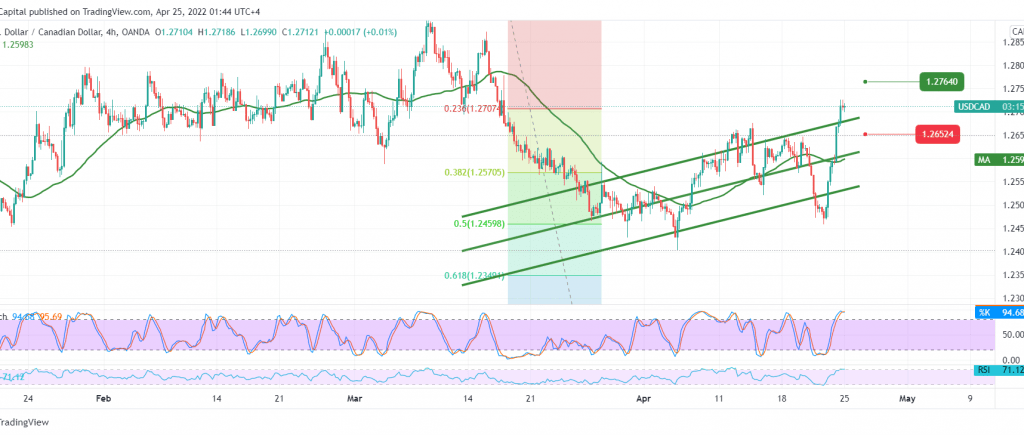

As we expected during the most recent analysis, the Canadian dollar jumped, touching the target that is required to be touched at the end of last week’s trading, around 1.2700, recording its highest level at 1.2726.

Technically, by looking at the 4-hour chart, we notice the 50-day moving average continuing to hold the price from above, accompanied by the stability of the RSI above the 50-day mid-line.

Therefore, with the pair’s success in confirming the breach of 1.2630 and most importantly 1.2660, so there may be a possibility to continue rising to visit 1.2770, a first target, taking into consideration that the breach of 1.2770 is a catalyst that enhances the chances of rising towards 1.2830 as long as the price is stable above 1.2630.

Trading stability below 1.2610 can thwart the proposed scenario and lead the pair to retest 1.2510 before attempting to rise again.

Note: We are awaiting a speech from the Governor of the Bank of Canada later in today’s session, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations