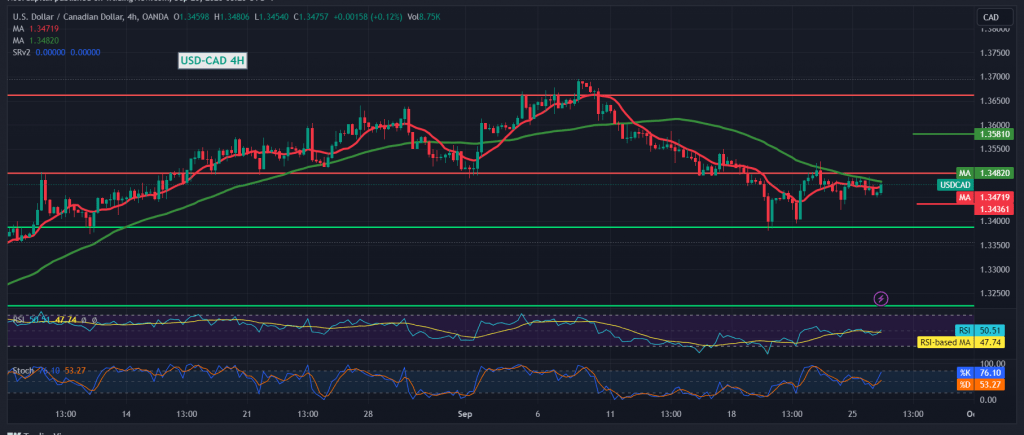

The technical outlook remains unchanged, and the pair’s movements have not significantly changed, maintaining the positive stability that began yesterday’s session, stable above 1.3440.

Technically, we are leaning towards positivity in our trading, but with caution, provided that we witness a clear breach of the pivotal resistance level at the psychological barrier of 1.3500, with the pair’s attempts to stabilize above the 50-day simple moving average, accompanied by the Relative Strength Index’s attempts to obtain more positive signals.

Therefore, the upward bias may be the most preferred during the day, knowing that breaching 1.3510/1.3500 will facilitate the task required to visit 1.3540 and 1.3580, awaited official stations.

From below, the return of trading stability with at least an hour candle closing below 1.3430 can thwart the upward attempts and lead the pair to the downward path, with targets of 1.3440, which may extend later towards 1.3360.

Note: Today we are awaiting highly sensitive economic data issued by the US economy, “Consumer Confidence,” and we may witness high volatility when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations