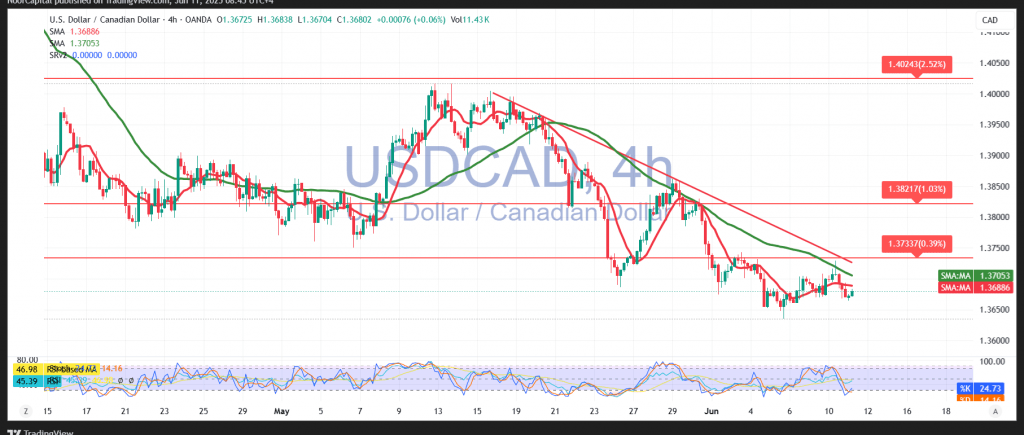

The technical outlook remains unchanged, with no significant shift in the pair’s behavior. The prevailing downtrend continues to dominate, reflecting persistent bearish sentiment.

A closer look at the 4-hour chart shows that the simple moving averages continue to apply downward pressure on price action. This is reinforced by the Relative Strength Index (RSI), which remains below the neutral 50 level, signaling sustained negative momentum.

As long as daily trading stays below 1.3730, the bearish outlook is intact. A confirmed break below 1.3680 would likely pave the way toward the next support targets at 1.3650 and 1.3600, respectively.

Market Risk Warning:

Today’s release of the U.S. Core Consumer Price Index (CPI)—both monthly and annual—is a key economic event and could inject significant volatility into the pair. CPI outcomes may heavily influence expectations surrounding Federal Reserve monetary policy.

Caution: With ongoing macroeconomic uncertainty and geopolitical tensions, traders should exercise vigilance and maintain tight risk management as all market scenarios remain possible.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations