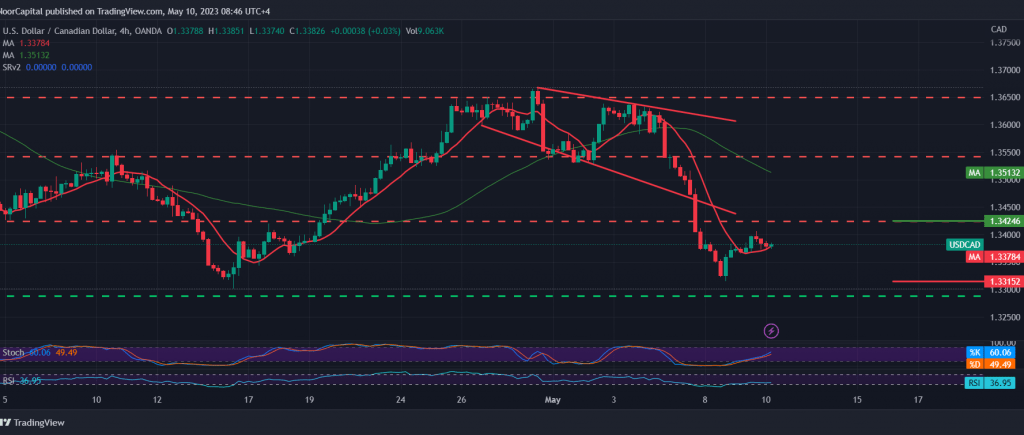

The technical outlook remains unchanged, and the pair’s movements did not change significantly, maintaining negative stability below the resistance level of the psychological barrier of 1.3400.

Technically, and by looking closely at the 4-hour chart, we find that stochastic provides negative signals, motivated by the continuation of the negative pressure from the 50-day simple moving average.

Therefore, we hold onto our negative expectations, knowing that the price’s decline below 1.3325 extends the pair’s losses as we await touching 1.3280 and 1.3250 for bearish targets, respectively, unless we witness the price consolidation above 1.3420.

The price’s consolidation above the resistance above 1.3420 postpones the chances of a decline. Still, it does not cancel it, and we may witness a temporary recovery, to retest 1.3470 before the start of the decline again.

Note: Today, we are awaiting high-impact economic data issued by the US economy, “US inflation data, consumer price index,” and we may witness high price fluctuations during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations