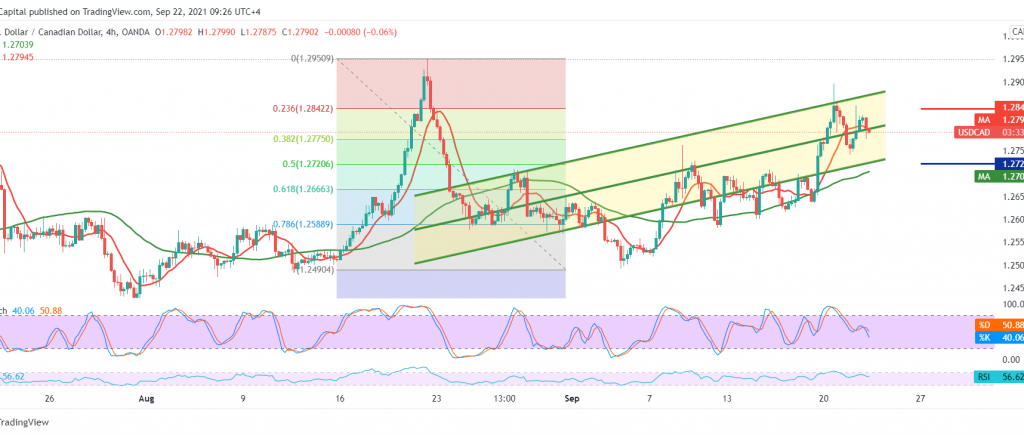

Positive trading dominated the movements of the Canadian dollar during the previous trading session within the bullish context, as we expected, approaching by a few points from the published target of 1.2860, recording its highest level at 1.2850.

Technically, and by looking at the 4-hour chart, we notice that the pair continues to obtain a positive stimulus from the 50-day moving average, in addition to the regularity of work within the ascending price channel.

Therefore, we tend to be positive, but on the condition that we witness a clear and strong breach of the 1.2850 resistance level, which increases the bullish trend’s strength so that the way is directly open towards 1.2900 1.2950, respectively.

To remind that activating the suggested bullish scenario requires daily trading to remain above the 1.2740 support level, and most importantly 1.2720, 50.0% Fibonacci correction.

Note: the RSI is affected by some negative signals.

| S1: 1.2740 | R1: 1.2850 |

| S2: 1.2670 | R2: 1.2905 |

| S3: 1.2630 | R3: 1.2955 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations