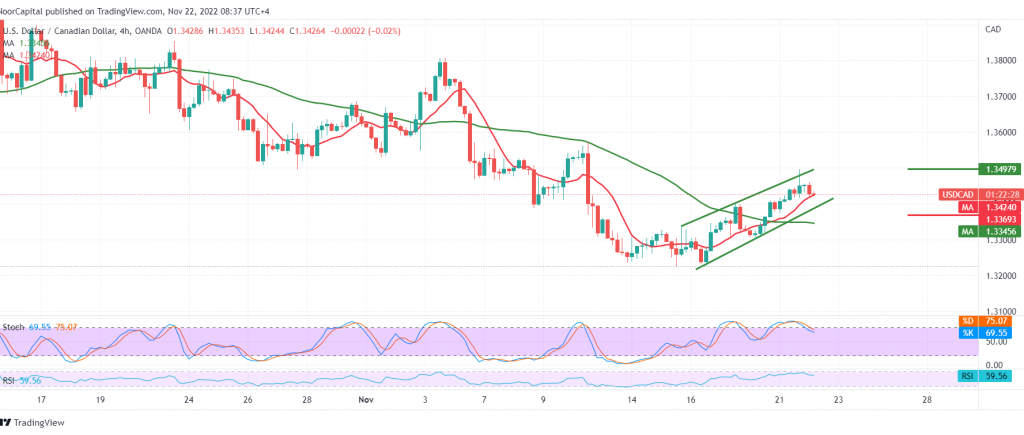

Trading tended to be positive, dominating the movements of the Canadian dollar after it confirmed the breach of the resistance level of 1.3350, to end its daily dealings above the mentioned level.

Technically, we tend to be positive in our trading, relying on the positive impulse from the 50-day simple moving average, which returned to hold the price from below, in conjunction with the positive signals from the relative strength index.

Therefore, the bullish bias is more likely today, targeting 1.3490 as a first target, considering that consolidation above the target level may extend the pair’s gains, so the door is open to visiting 1.3350, as long as daily trading remains stable above 1.3370.

From below, if the pair decline below 1.3370, we may witness a bearish bias, targeting 1.3310.

Note: Stochastic is trying to get rid of the current negativity.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations