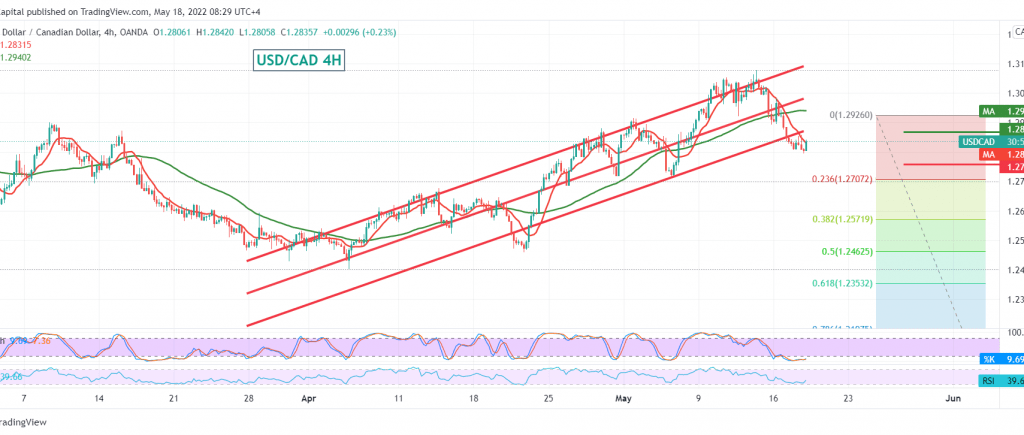

Quiet trading dominated the movements of the Canadian dollar, tending to the negative after it temporarily failed to maintain stability above the 1.2880 support level, approaching the target that is required to be visited around 1.2775, recording its lowest level at 1.2795.

Technically, there are cohesion attempts above the psychological support level of 1.2800. With careful consideration of the chart with a 60-minute interval, we find that the 14-day momentum indicator is trying to obtain more bullish momentum and the beginning of positive signs appearing on the momentum indicator.

We may witness a bullish bias in the coming hours, whose target is to retest 1.2865, knowing that consolidation above the mentioned level is a catalyst that enhances the chances of touching 1.2895 as long as the price is stable intraday above 1.2800.

The decline below 1.2800 renews the pair’s chances of falling, so we will be waiting for 1.2765 and 1.2720 for the next official station.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations