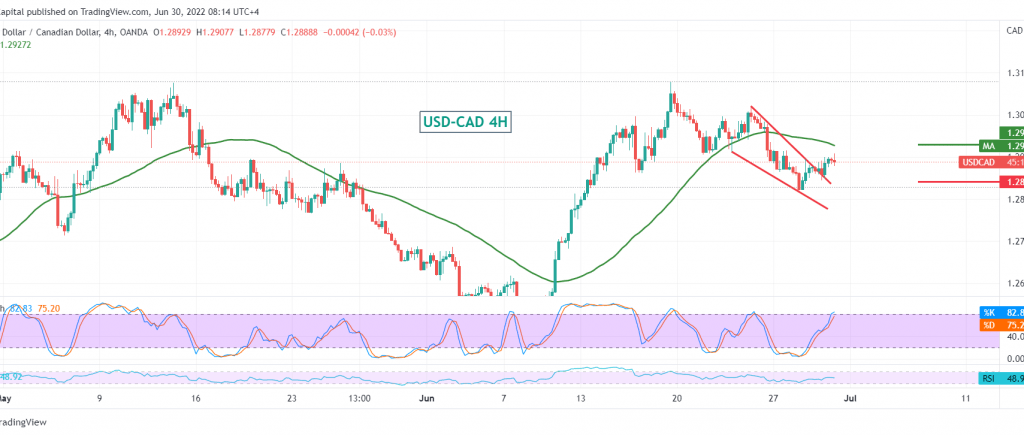

The Canadian dollar benefited from the strong support floor published during the previous analysis, located at the price of 1.2840, which was the target to be touched, to force the pair to maintain the bullish path to retest the resistance of the psychological barrier of 1.2900.

Technically, and by looking at the 4-hour chart, despite the positive movements, the 50-day moving average is still pressuring the price from above, accompanied by stochastic reaching overbought areas.

The positivity needs to be confirmed by cohesion above 1.2900 to visit 1.2930. We must pay close attention and monitor the price behaviour of the pair around 1.2930 because its breach increases and accelerates the strength of the bullish bias, paving the way for the pair to visit 1.2980.

If the pair fails to consolidate above 1.2900 and returns to trading below 1.2840, thus leading the pair to complete the descending path, which targets around 1.2800 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations