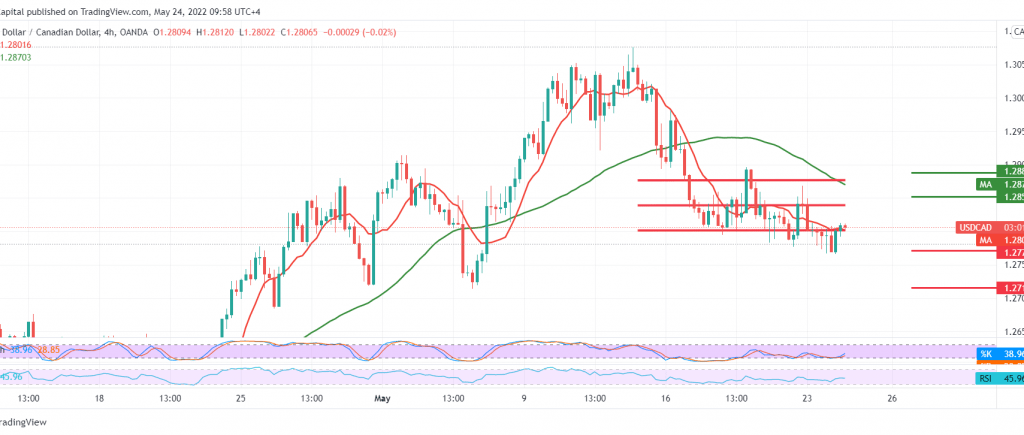

Trading tilted to the negative, which dominated the Canadian dollar’s movements yesterday, to find a solid support floor near the 1.2770 level, forcing it to rebound to the upside. It is now hovering around the 1.2810 level.

Technically and carefully considering the 4-hour chart, we find a conflict in the technical signals. We found the stochastic indicator trying to obtain positive signals accompanied by the stability of trading above the strong support 1.2770, supporting the return of the rise. But, on the other hand, we find the 50-day moving average pressing on the price from the top and the stability of trading below the previously broken support, which turned to the 1.2850 resistance level.

With conflicting technical signals, we prefer to monitor the price behavior of the pair and wait for the activation of the following pending orders:

Activating long positions requires consolidation and price stability above 1.2850 to target 1.2885, and gains may extend towards 1.2930.

Activating sell orders is confirmed by breaking 1.2770, and this facilitates the task required to visit 1.2720 and 1.2680, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations