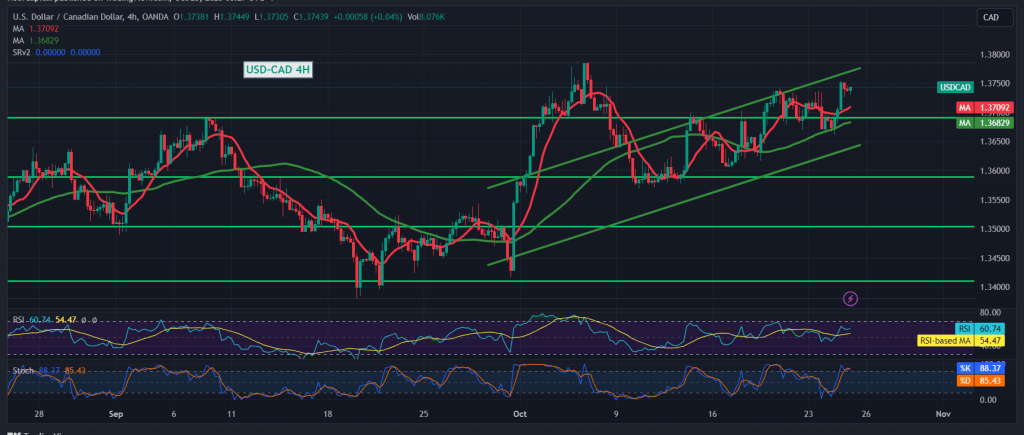

Positive trading regained control of the Canadian dollar’s movements yesterday after consolidating above the strong resistance at 1.3715, recording its highest level at 1.3754.

On the technical side today, we are leaning towards positivity in our trading, relying on the regularity of work within the ascending price channel shown on the 4-hour chart and the return of trading stability above the 1.3680 level.

Stability of intraday trading above the psychological barrier of 1.3700, and in general, above the immediate support floor of 1.3680, the upward bias is the most preferable, targeting 1.3780 as the first target, and the gains may extend later to visit 1.3815.

Only a return to trading stability below the support level of 1.3680 can thwart the bullish scenario and put the pair under negative pressure, with a target of 1.3625 and extending towards 1.3890.

Note: Today, the markets are awaiting high-impact data from the Canadian economy, represented by the Bank of Canada’s monetary policy report, interest statement, and interest rate decision, as well as the speeches of the chairman of the Federal Reserve and the European Central Bank. We may witness fluctuation in the markets during the release of these data.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations