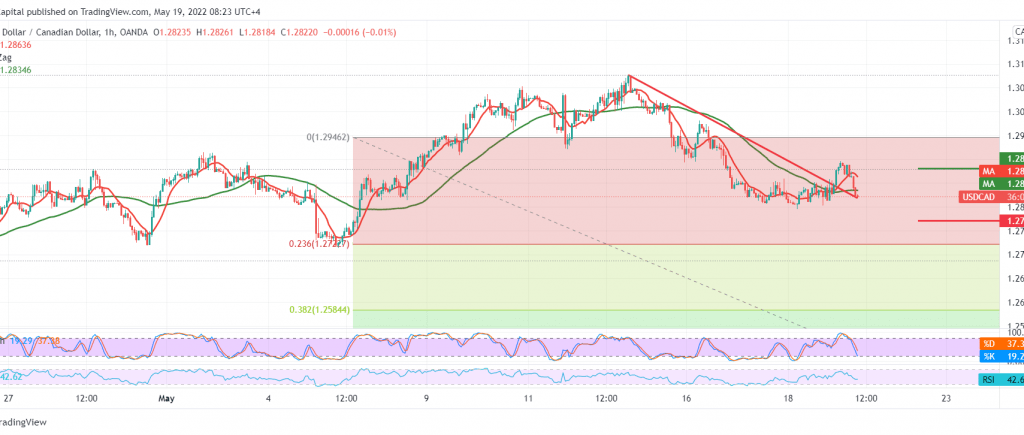

Mixed trades dominated the movements of the Canadian dollar during the last session’s trading to succeed in retesting the resistance level required to be touched during the previous analysis at 1.2895, recording its highest level at 1.2895.

Technically, the 50-day simple moving average started to pressure the price from above, accompanied by the stability of intraday trading below the strong resistance level at 1.2865, and most importantly below 1.2885.

Therefore, the bearish scenario is the most likely in the coming hours, provided that 1.2800 is confirmed, which puts the pair under negative pressure, with its initial target around 1.2775, while its second target is located near 1.2740.

Only from the top the overshoot and the rise above 1.2885 can thwart the bearish scenario, leading the Canadian dollar to recover to visit the first ascending target 1.2935 and 1.2965, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations