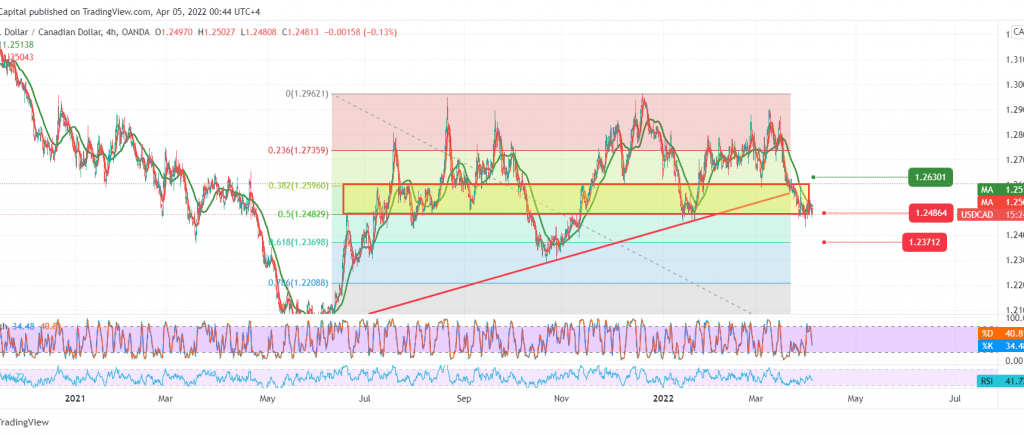

The Canadian dollar found it challenging to break the critical support floor for the current trading levels at 1.2470, representing one of the most critical directional keys that helped it retest 1.2540.

Technically, and by looking at the 4-hour chart, we notice the pair’s attempts to gain additional momentum from the stochastic indicator, on the other hand, the 50-day moving average is still an obstacle that prevents the pair from rising and meeting around the 1.2540 resistance level.

We prefer to follow the price behavior of the pair, noting that the break of 1.2470 50.0% Fibonacci retracement increases the strength of the main bearish trend to open the door towards 1.2370, 61.80% retracement, the next official station.

Suppose the pair consolidated and built on the 1.2470 support level and re-crossed the upside to the 1.2550 resistance level. In that case, this is a signal to complete the required bullish correction towards 1.2585 and 1.2630, respectively.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2470 | R1: 1.2550 |

| S2: 1.2430 | R2: 1.2585 |

| S3: 1.2395 | R3: 1.2635 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations