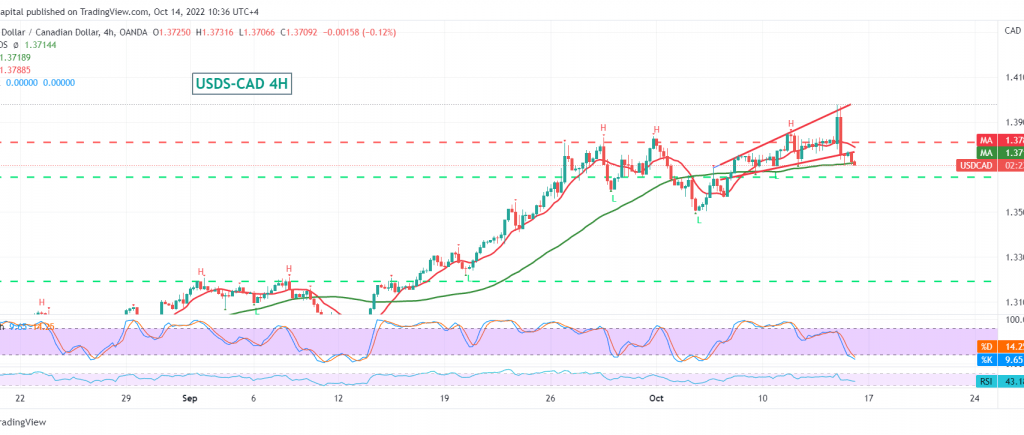

The Canadian dollar declined quickly yesterday after hitting the resistance level of 1.3980, which forced it to trade negatively, and it is now hovering around the psychological support floor of 1.3700.

Technically, we tend to the negativity, relying on the negative crossover of the simple moving averages that pressure the price from above and the stochastic losing the bullish momentum.

The expected daily trend tends to the downside, and the negative targets start at 1.3620, knowing that breaking it will extend the pair’s losses so we will be waiting for 1.3565.

The return of stability above 1.3890 can completely thwart the bearish scenario and lead the pair to resume the bullish path towards 1.4070.

Note: “US Retail Sales” is du and may witness price fluctuation.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations