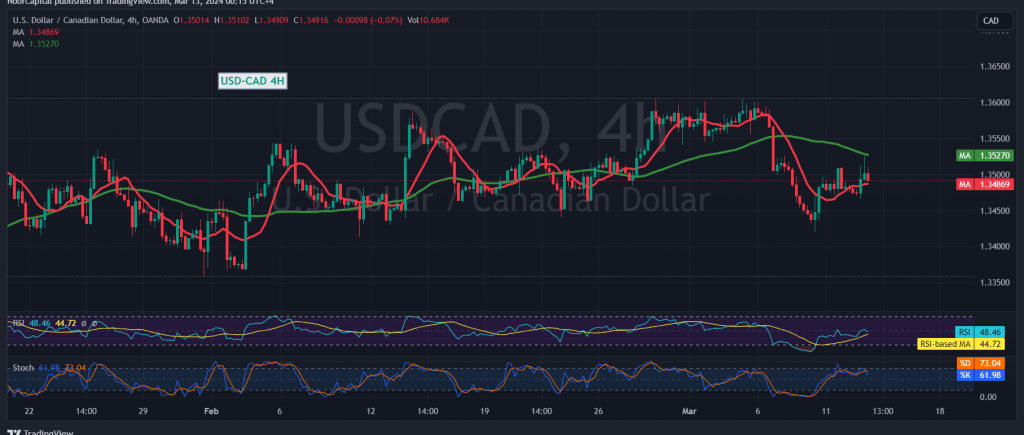

In the previous trading session, the Canadian dollar experienced a limited upward trend, with movements pushing towards a retest of the psychological barrier resistance level of 1.3500, ultimately reaching its peak at 1.3525.

From a technical analysis perspective, our outlook tends towards negativity. This is based on the emergence of negative signals from the Stochastic indicator, which has begun to exhibit a gradual loss of upward momentum on the 4-hour timeframe. Additionally, there is continued downward pressure from the simple moving averages.

Consequently, our expectations remain pessimistic, with a target set at 1.3460. A breach of this level would likely intensify and accelerate the downward trend, potentially leading to a further decline towards 1.3430, with potential losses extending to 1.3380 thereafter.

However, it’s worth noting that a consolidation above the levels of 1.3510 and particularly 1.3520, with the closure of at least an hour candle, would postpone the downside opportunities. In such a scenario, we may observe an upward bias aimed at retesting levels of 1.3560 and 1.3610.

Investors should remain vigilant and monitor price movements closely, considering the potential for both upward and downward trends.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations