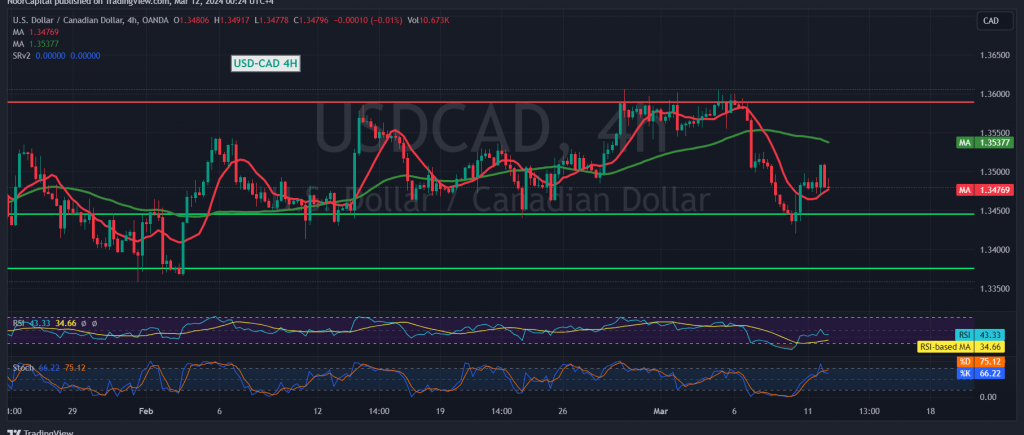

During the initial trading session of the week, the movements of the Canadian dollar were characterized by a limited upward trend, with the currency reaching its peak around the psychological resistance barrier of 1.3510.

From a technical analysis perspective, we are inclined towards a negative outlook, primarily due to the emergence of negative signals on the Stochastic indicator. This indicator has begun to exhibit a gradual loss of upward momentum on the 4-hour timeframe, coinciding with continued downward pressure from the simple moving averages.

Consequently, the prevailing bias favors a downward trajectory, with an initial target set at 1.3430. A breach of this level would likely intensify and accelerate the downward trend, potentially leading to a further decline towards 1.3380, with subsequent losses extending to 1.3340.

However, should the price consolidate above the critical levels of 1.3510, particularly 1.3520, with the closure of at least an hour candle, it would postpone the downside opportunities. In such a scenario, we may witness an upward bias aimed at retesting 1.3560 and 1.3610.

Investors should exercise caution today due to the release of high-impact economic data from both the United States and the United Kingdom, including core consumer prices on a monthly and annual basis (excluding food and energy), as well as monthly and annual consumer prices. These data releases may result in significant price fluctuations upon their announcement.

By refining the language and structure of your analysis, it becomes more precise and informative, effectively conveying the technical dynamics of the Canadian dollar while also highlighting potential risks and market catalysts.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations