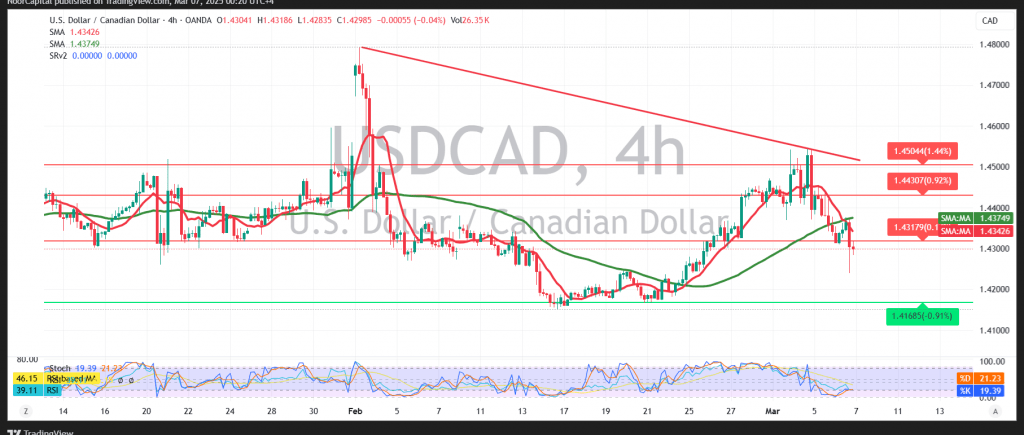

The Canadian dollar continues its gradual upward movement, following the expected bullish path from Negative pressure dominated the Canadian dollar’s movement during the previous session. The recent price action—marked by a low of 1.4240—suggests that a break below the support level of 1.4410 could trigger further downside, with a target around 1.4340, compensating for recent buying positions.

Technical Outlook

- Bearish Indicators:

- On the 4-hour chart, simple moving averages have begun to cross negatively, exerting pressure from above.

- This is supported by clear negative signals from the 14-day momentum indicator.

- Downside Scenario:

- There is a possibility of a bearish trend during today’s session, with the next target at 1.4265.

- Should the decline continue, prices may further drop toward 1.4210.

- Bullish Contingency:

- Conversely, an upward move with price consolidation above the resistance level of 1.4420 could halt the bearish scenario and steer the pair toward an upward target of 1.4535.

Risk Warning

Today, high-impact US economic data—including non-farm payrolls, unemployment rates, and average wages—is scheduled for release, which could lead to significant volatility.

Economic Data Impact:

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Trading foreign exchange involves risk, and traders should always conduct their own research and exercise caution.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations