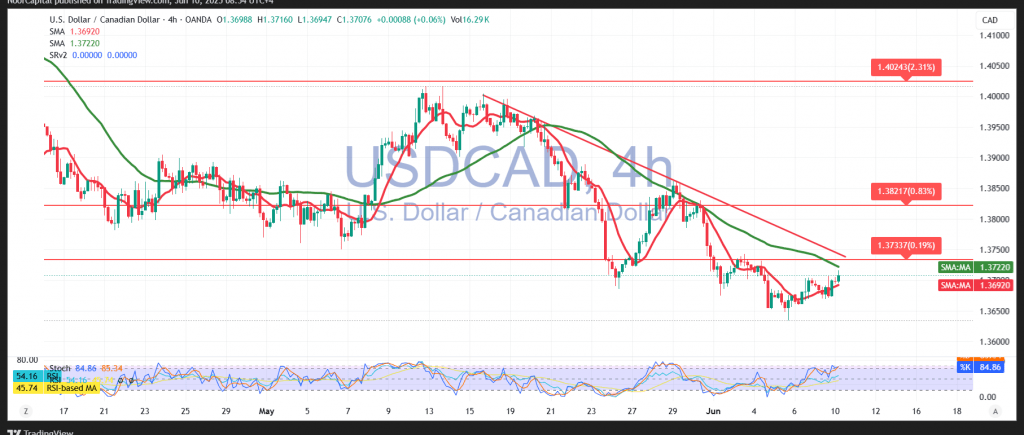

The Canadian dollar remains under clear downward pressure, with the USD/CAD pair extending losses across multiple sessions and registering a new low at 1.3669 during the week’s opening trade.

From a technical standpoint, the 4-hour chart shows persistent bearish momentum, with simple moving averages (SMAs) pressing down from above and reinforcing resistance. Additionally, the Relative Strength Index (RSI) is hovering near overbought thresholds on intraday timeframes, suggesting that any upward attempts may be limited and met with renewed selling.

Given the prevailing conditions, a confirmed break below 1.3680 would likely clear the path toward the next target at 1.3650, reinforcing the short-term bearish outlook. This scenario remains valid as long as the pair continues to trade below the key resistance level at 1.3760.

Should the pair fail to breach lower and instead rebound above 1.3760, it would indicate a shift in sentiment and possibly open the door for a broader correction or trend reversal. Until then, the downtrend remains dominant.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations