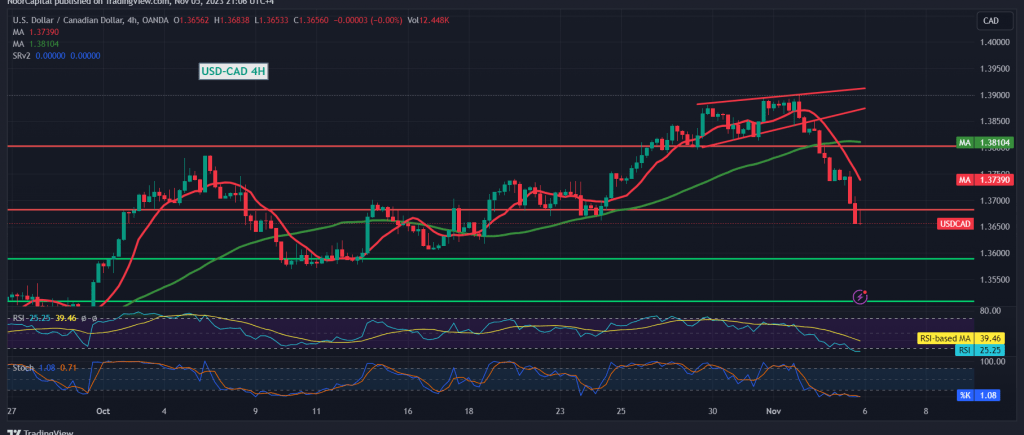

The Canadian dollar finds itself under negative pressure as market conditions persist. Analyzing the technical aspects, we observe a consistent downward trend on the 4-hour chart, with the simple moving averages exerting consistent pressure on the currency from above. Additionally, the Relative Strength Index signals negative trends.

As long as intraday trading remains below the 1.3680 mark and, more broadly, below 1.3800, the Canadian dollar is expected to continue facing downward pressure. The immediate target lies at 1.3585, and should this level be breached, it could lead to further losses, with the subsequent target set at 1.3515.

A significant reversal of the bearish trend would require the currency to stabilize above the 1.3800 resistance level. Such a development could indicate a shift back to an upward trajectory, with initial targets beginning at 1.3930. However, until then, the Canadian dollar remains under negative pressure.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations