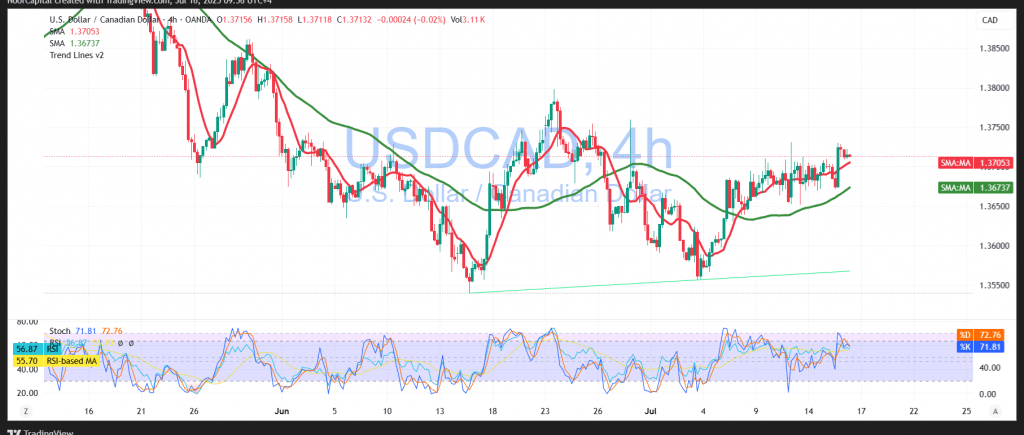

The USD/CAD pair continued its steady upward movement, in line with the expected bullish trend, approaching the previously identified technical target at 1.3740 after reaching a session high of 1.3730.

Technical Outlook – 4-Hour Timeframe:

The 50-period Simple Moving Average (SMA) continues to provide dynamic support, reinforcing the pair’s bullish structure on the daily chart. Additionally, price action remains above the key support level at 1.3680, maintaining the momentum bias in favor of the bulls.

However, some early signs of weakness are beginning to emerge on the Relative Strength Index (RSI), suggesting that upside momentum could temporarily slow or give way to minor corrections.

Probable Scenario – Bullish Bias:

As long as the pair maintains stability above the psychological and technical support at 1.3680, the bullish scenario remains the most likely. The next upside targets are:

- 1.3740 (near-term resistance)

- 1.3770 (next technical barrier)

Alternative Scenario – Short-Term Correction:

If the pair loses momentum and breaks below 1.3680, it may trigger a downward correction, with potential support levels at:

- 1.3645

- 1.3610

Market Catalyst:

Volatility is expected to rise today with the release of high-impact U.S. economic data, specifically the monthly and annual Core Producer Price Index (PPI). This data could influence the dollar and drive strong market reactions.

Caution:

The risk environment remains elevated amid global trade and geopolitical tensions. All scenarios remain on the table, and disciplined risk management is strongly advised.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations