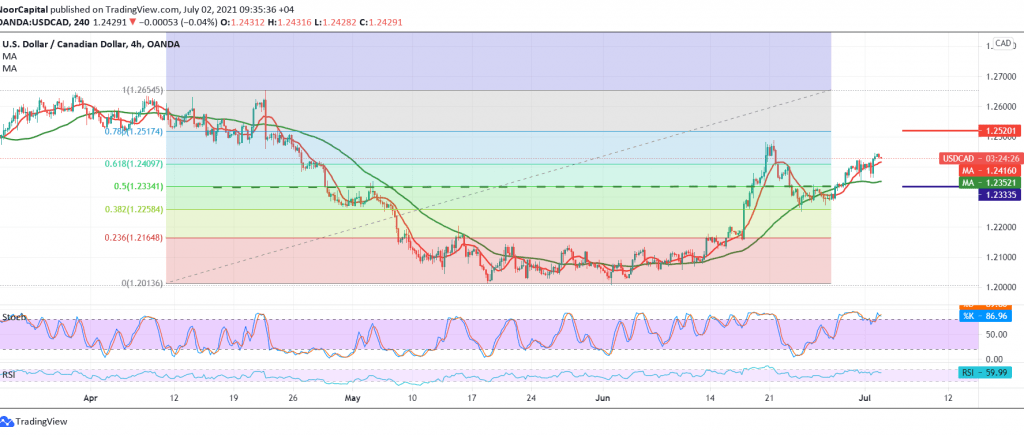

Positive trading dominated the movements of the Canadian dollar within the completion of the bullish corrective slope that we mentioned in all reports of the week, touching the required target 1.2410, recording its highest level during the previous trading session at 1.2445.

Technically, with the pair’s success in confirming the breach of the previously breached 1.2340, which is now turned into a support level, 50.0% correction, in addition to the positive stimulus coming from the 50-day moving average with bullish bias, we target 1.2465 and 1.2500, taking into account that the breach of 1.2520 extends the pair’s gains to visit 1.2600.

On the downside, trading below 1.2330, delaying the chances of rising, we witness a temporary bearish bias that aims to retest 1.2300 and 1.2260 before rising again.

Note: NFP is due today and we may witness high volatility.

| S1: 1.2380 | R1: 1.2465 |

| S2: 1.2340 | R2: 1.2500 |

| S3: 1.2260 | R3: 1.2545 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations