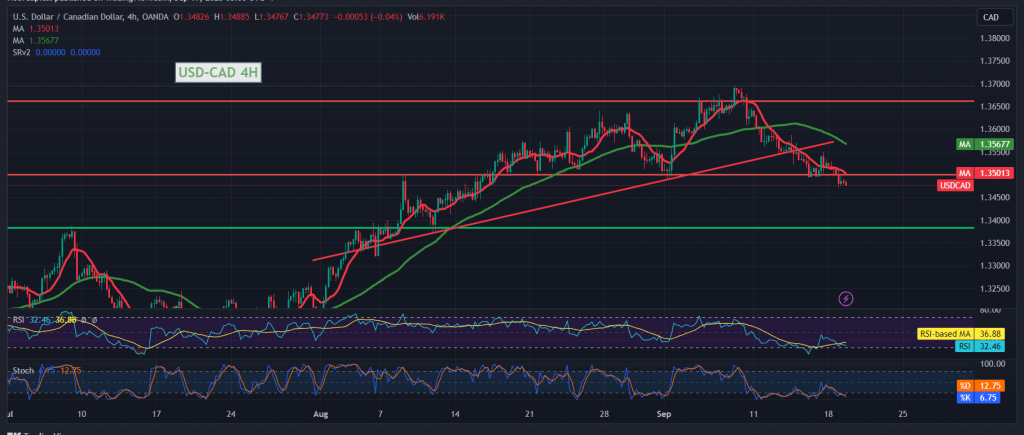

The downward trend continues to control the movements of the Canadian dollar after it failed to maintain stability above the support level of 1.3500, witnessing the intraday movements stabilizing around its lowest level during early trading of the current session, 1.3475.

Technically, we are leaning towards negativity, relying on the negative crossover of the simple moving averages that continue to pressure the price from above and the clear negative signals on the Relative Strength Index on short time frames.

From here, with intraday trading remaining below 1.3510, the bearish scenario is valid and effective, targeting 1.3450. We must pay close attention to the fact that breaking the aforementioned level extends the pair’s losses, opening the way directly for us to wait for 1.3400, and the losses may extend later towards 1.3365.

Only from the top can we cross upwards, and the price consolidates above 1.3510 with the closing of at least an hour candle. This postpones the chances of a decline but does not cancel them, and we may witness an upward bias to retest 1.3550 and 1.3580.

Note: Today we are awaiting high-impact economic data issued by the Canadian economy, “annual core consumer prices,” and we may witness high volatility at the time of the news’s release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations