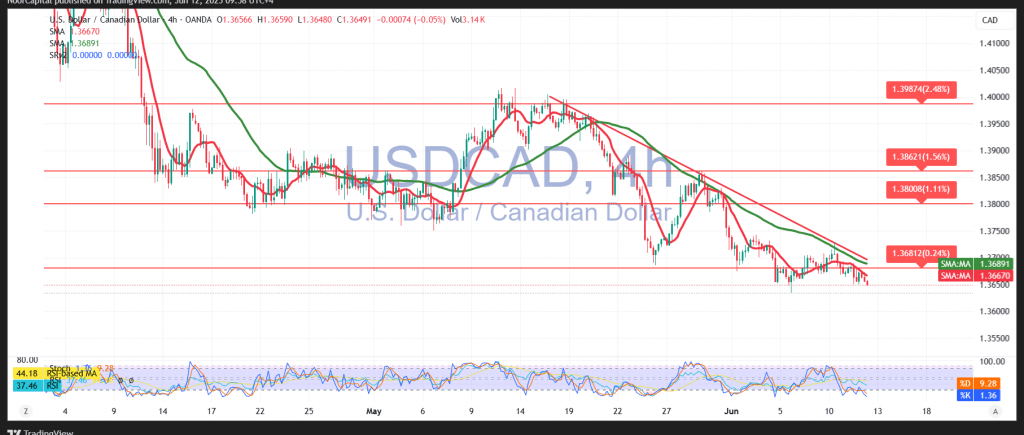

The Canadian dollar continued its decline against the U.S. dollar within the expected bearish trend, reaching the first target of 1.3650 outlined in the previous technical report, with the pair recording a session low of 1.3648.

From a technical standpoint, the 4-hour chart confirms the persistence of downside pressure. The simple moving averages continue to cap gains from above, while the Relative Strength Index (RSI) remains below the 50 level, reinforcing bearish momentum and signaling continued weakness in buying interest.

With daily trading holding below the 1.3675 resistance level, the technical outlook supports the potential for further declines. A confirmed break below 1.3650 would likely open the path toward the next targets at 1.3620 and 1.3590.

Note: Caution is warranted ahead of the release of high-impact U.S. economic data—specifically, the monthly and annual Core Producer Price Index (PPI). The data may cause significant volatility in USD/CAD and other USD-linked instruments.

Warning: Risk levels remain elevated due to ongoing global trade tensions, and multiple market scenarios are possible.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations