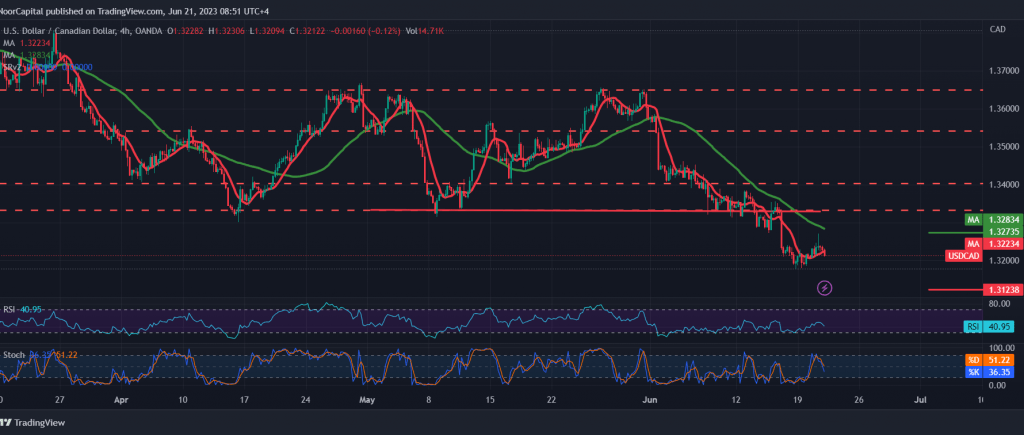

The technical outlook is unchanged, and the Canadian dollar’s movements did not change much, maintaining negative stability, as we expected, after the 1.3270 resistance managed to limit the bullish bias, to see the current movements stabilize around its lowest level during the early trading of the current session at 1.3209.

Technically, the current movements of the pair witness a limited bullish bias, building on the support of 1.3180, and upon closer look, we find the 50-day simple moving average still constitutes an obstacle in front of the pair, accompanied by the clear negative signs on the stochastic indicator, which started to lose bullish momentum.

We tend to be negative, but with caution, relying on trading remaining below the strong resistance level 1.3260/1.3250, waiting to touch 1.3180, knowing that decline below the mentioned level facilitates the task required to visit the official target 1.3130, knowing that crossing upwards and rising above 1.3260 can thwart the expected bearish scenario. The pair is recovering temporarily, targeting 1.3310 and 1.3350, respectively.

Note: Today, we await high-impact economic data issued by the British economy, the annual “consumer price index”, and “the testimony of the Federal Reserve Chairman” on the semi-annual monetary policy report before the House Financial Services Committee. We may witness a high price fluctuation during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations