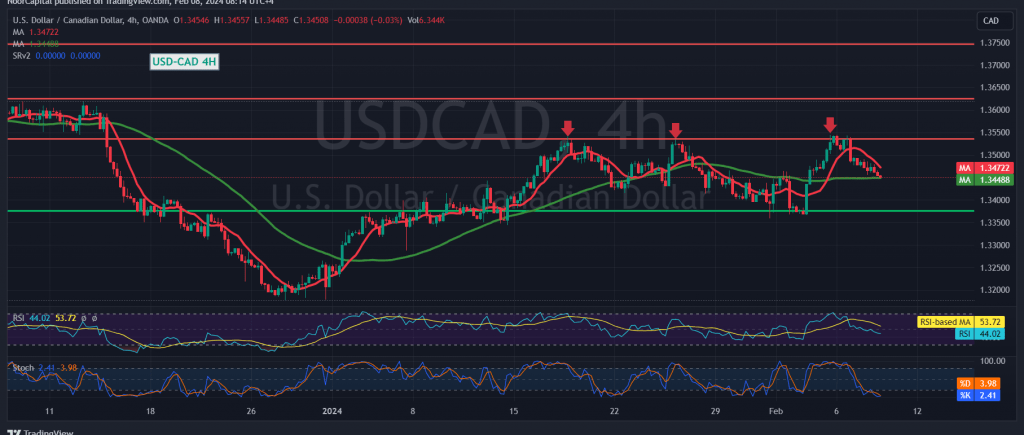

In the wake of the preceding technical report, the Canadian dollar grappled with a prevailing downward trend, successfully reaching the initial target at 1.3470. Presently, trading activity hovers around its morning low, settling at 1.3450.

Technical Analysis: Negative Momentum Signals Bearish Outlook

Today’s technical analysis veers towards negativity, underscored by the adverse intersection of simple moving averages exerting downward pressure on prices. Furthermore, discernible negative signals emanate from the 14-day momentum indicator, accentuating the bearish sentiment.

Projected Trajectory: Downward Momentum Prevails

As daily trading persists below the resistance levels of 1.3480 and, crucially, 1.3520, the downward trajectory retains prominence, targeting 1.3430. Vigilance around this level is imperative, as breaching it augments and accelerates the momentum of the daily downward trend, potentially leading to an initial target of 1.3385.

Potential Reversal Scenario and Upside Targets

Conversely, a resurgence in stability above 1.3520 signals a cessation of the bearish sentiment, paving the way for an official upward trajectory. Initial targets in such a scenario commence at 1.3550, with further gains extending towards 1.3590.

Warning: Heightened Risk Amidst Geopolitical Uncertainties

Traders are urged to exercise caution, given the elevated risk level attributable to ongoing geopolitical tensions, which may precipitate heightened price volatility.

By closely monitoring critical support and resistance levels while factoring in geopolitical dynamics, traders can navigate the fluctuations within the Canadian dollar with prudence and adaptability.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations