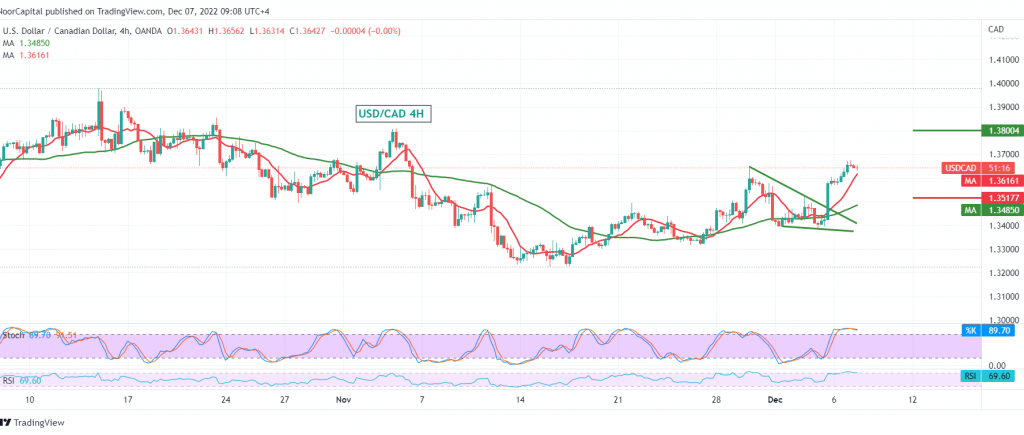

Positive trades dominated the movements of the Canadian dollar within the expected bullish path in the last analysis, touching the first target at 1.3665, recording its highest level at 1.3676.

Technically, the 50-day simple moving average continues to hold the price from below, and this comes in conjunction with the clear positive signs on the momentum indicator.

Therefore, the bullish bias is more likely during the day, provided that we witness the breach of 1.3690, which is a catalyst that extends the pair’s gains, as we await further rise towards 1.3735 & 1.3800.

Note: Stochastic is trying to get rid of the current negativity.

Note: We are awaiting high-impact economic data from the Canadian economy today, “the interest rate decision and statement of the Bank of Canada,” and we may witness high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations