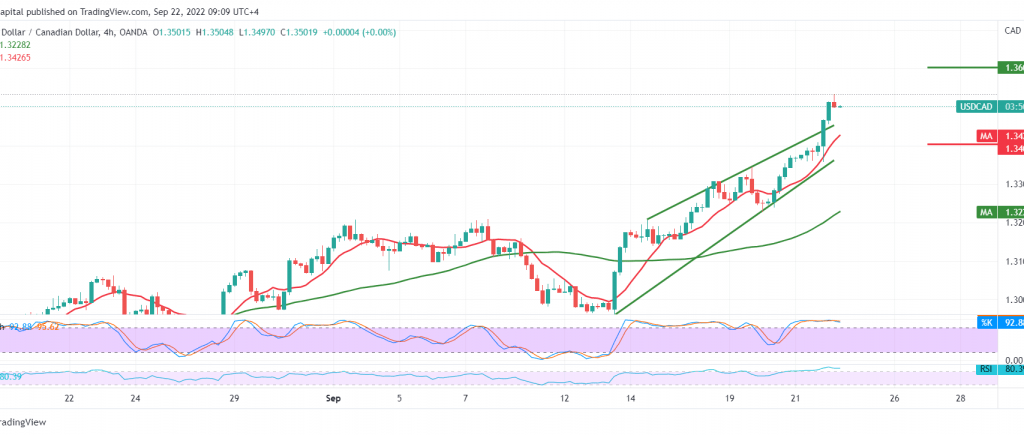

The Canadian dollar continues its sharp successive rise within the expected bullish context, surpassing the first target required to be achieved at 1.3425, recording its highest level at 1.3532 during the early trading of the current session.

From the technical analysis point of view, the pair succeeded in breaching the 1.3425 resistance level, and the current moves are witnessing stability above it. We find the simple moving averages supporting the bullish price curve and the pair’s continuing bullish momentum on the short time frames.

Therefore, the continuation of the rise is the most preferred scenario today, targeting 1.3570, knowing that its breach will motivate the price to get more rises, waiting for 1.3640.

From below, the return of the daily stability below 1.3400 puts the price under negative pressure to retest 1.3300 before attempting to rise again.

Note: Stochastic is around overbought areas and we may witness price fluctuation before getting the official direction.

Note: We are awaiting high-impact data from the UK “British interest rate decision, monetary policy summary, and MPC votes,” and we may see price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations