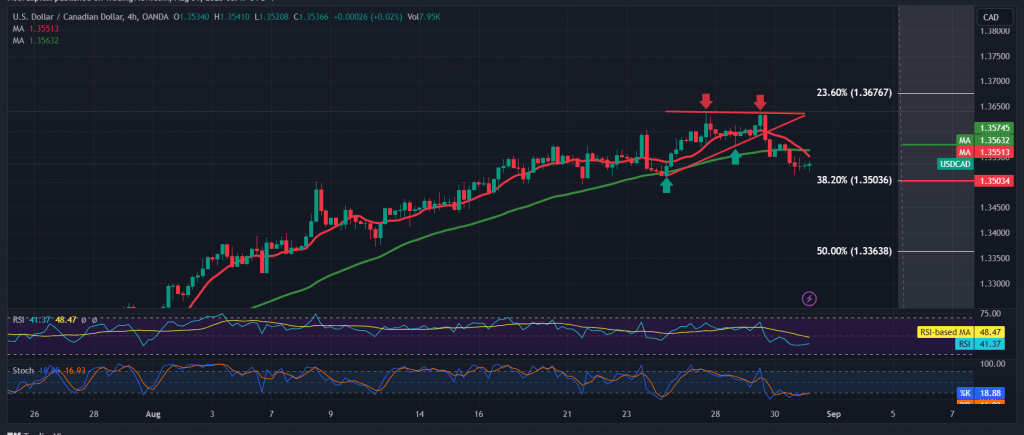

Negative trading dominated the movements of the Canadian dollar within the retest technique, as we explained during the previous technical report, touching the first target required to be retested at the price of 1.3530, recording its lowest level at 1.3513.

The technical outlook remains unchanged, and the pair’s movements have not changed, with the continued negative pressure on the simple moving averages, and the 50-day average meets around the 1.3570 resistance and adds more strength to it, in addition to the negative signals coming from the Stochastic indicator.

This encourages us to maintain our negative expectations, knowing that sneaking below 1.3500 will facilitate the task required to retest 1.3475 and 1.3430, respectively, as long as trading remains stable below 1.3570.

Note: Today we are awaiting high-impact economic data issued by the US economy, “Personal Consumption Spending,” and we may witness high price fluctuation when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations