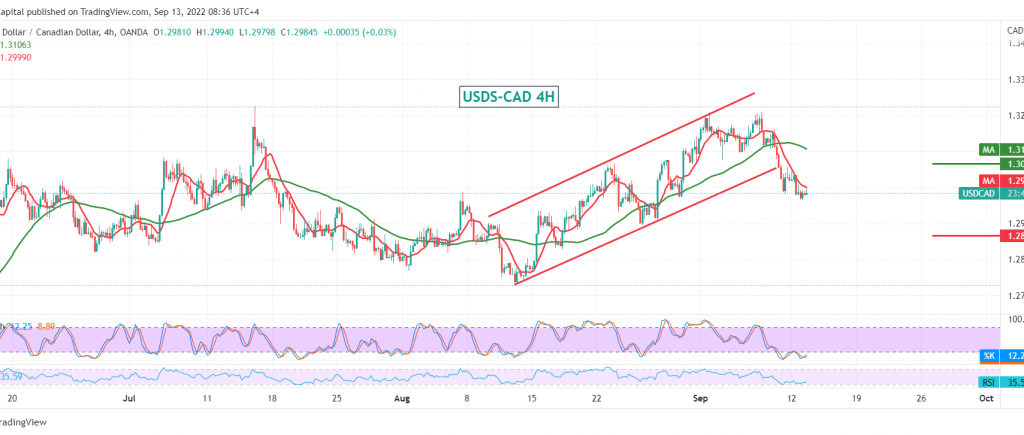

The technical outlook remains unchanged, to find the Canadian dollar maintaining negative stability, as we expected, touching our first target to be achieved at 1.2975, recording its lowest level at 1.2963.

Technically, and carefully considering the chart, the pair confirmed the breach of 1.3060, and the current moves are witnessing stability below the mentioned level; we find the negative features still dominating the stochastic indicator and providing more bullish momentum loss.

The common tendency during today’s trading session is bearish, knowing that the decline below 1.2960 facilitates the task required to visit 1.2920 initially, and losses may extend towards 1.2860 as long as the price is stable below 1.3090.

Note: US inflation data is due out today through CPI, it has a big impact, and we may see price swings.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations