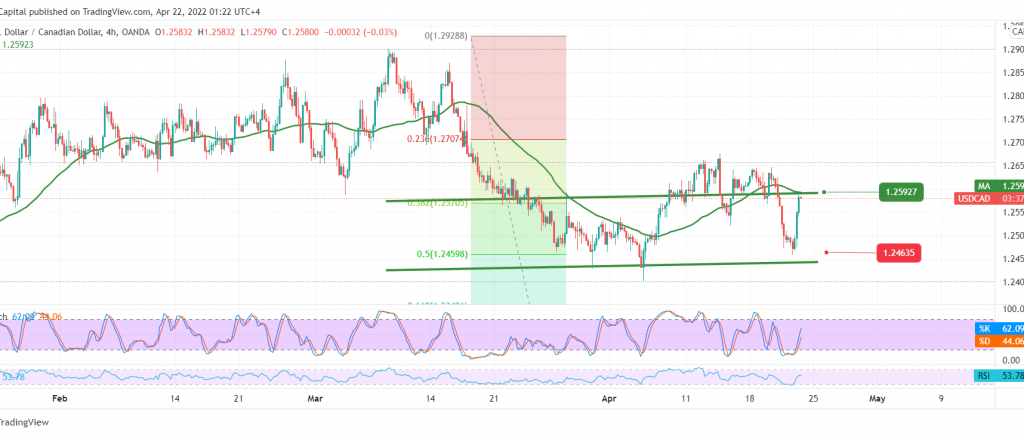

The pivotal support levels at 1.2460 managed to limit the bearish bias, which forced the pair to rebound bullishly again, heading to touch the required retest target at 1.2660, bypassing the target to record the highest 1.2590.

Technically and carefully considering the 4-hour chart, the positive signs on the stochastic oscillator coincided with the clear positive signs on the 14-day momentum indicator.

With stable intraday trading above 1.2500 and 1.2460, 50.0% Fibonacci correction, the bullish bias is most likely, targeting 1.2630, considering that its breach is likely a catalyst that extends the pair’s gains to visit 1.2670. Gains may extend later towards 1.2700 if the price is stable above 1.2460.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations