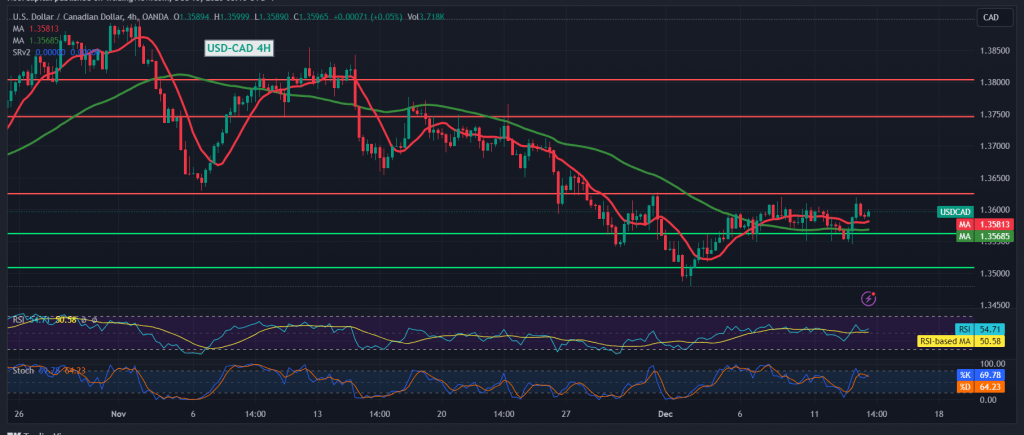

The Canadian dollar successfully reached the initially targeted level at 1.3540, establishing a robust support base that propelled the pair towards an upward rebound, testing the formidable resistance level at 1.3620.

From a technical standpoint today, our trading sentiment leans towards positivity, underpinned by the price’s consolidation above the aforementioned support at 1.3540. This positive outlook is reinforced by the return of the simple moving averages, providing a favorable incentive. Additionally, clear positive signals are observed on the 14-day momentum indicator.

Hence, the probability of an upward bias is heightened. The initiation of an upward jump and price consolidation above 1.3630 serve as motivating factors that could enhance the gains. Anticipation centers around targets at 1.3660 and 1.3690, respectively.

On the downside, the confirmation of breaking the support floor at 1.3540 would promptly halt the proposed bullish scenario, redirecting the pair towards an initial retest of 1.3500.

A word of caution: Today, heightened market volatility is expected as we await high-impact economic data from the US, including inflation numbers via the “Producer Price Index,” a Federal Reserve Committee statement, a Federal Reserve press conference, interest rate decisions, and economic forecasts. Be prepared for significant price fluctuations at the time of the news release. Exercise prudence in navigating these dynamic market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations